- by New Deal democrat

Before discussing this morning’s reports on existing home prices, let’s start with a look at new listings and total active listings of housing inventory, which are very instructive:

This information is not seasonally adjusted, and obviously follows a seasonal pattern. The important thing to notice is that since late last year, new listings have collapsed to levels even lower than conquerable months just before and during the onset of the pandemic. Basically, mortgage rate increases have frozen existing homeowners in place.

And with the extreme shortage of inventory, prices have not corrected (vs. new house prices, which have declined over 15% from their peak).

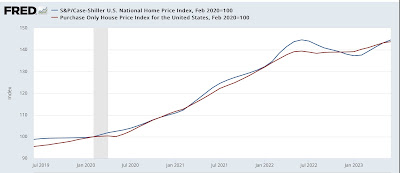

In June, the FHFA (red) reported that existing house prices increased 0.3%, the 10th seasonally adjusted increase in a row:

YoY prices are 3.1% higher as measured by that index. The Case Shiller index (blue) is not seasonally adjusted, but YoY prices are down less than -0.1%:

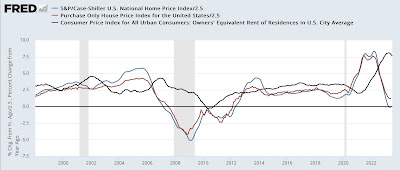

As I have frequently pointed out, house prices typically have led Owners’ Equivalent Rent in the CPI (black above) by 12 or more months. Here is the close-up of the last 4 years:

As I forecast many months ago, OER was going to start decelerating, perhaps sharply, on a YoY basis, following house prices. It took OER somewhat longer (about 24 months vs. 18 months for house prices) to go from pandemic trough to post-pandemic peak, so now the question is, will there be a similar delay? If so, then OER is not going to decline below 3% until about autumn of next year. Keeping in mind that inflation ex-shelter is only about 1% YoY even now, will the Fed insist that OER do so before lowering interest rates?