- by New Deal democrat

As I have repeated for the past several months, in the current economy the personal spending and income report is just as important as the jobs report. That’s because, despite the downturn in manufacturing production and many parts of the housing market, consumer spending especially on services has continued to power the economy forward.

Today’s report contained more good news on spending, but not such good news on income, saving, sales, or inflation.

Nominally personal income rose 0.2%, and personal spending rose a strong 0.8% (that was already telegraphed by the strong July retail sales report). But since the deflator increased 0.2% as well, real income was flat, while real spending rose 0.6%. This is shown In the below graph in which both real personal income (red) and spending (blue) are normed to 100 as of the onset of the pandemic:

Real income is up 3.8% since just before the pandemic, while real spending has zoomed 9.3%.

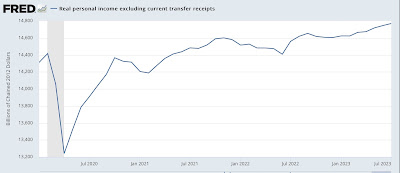

One of the 4 important coincident measures for the NBER, real personal income less government transfer receipts, also rose 0.2% to another new high:

Although I won’t bother with a graph, this is a 1.4% increase YoY.

On the spending side, here’s how goods vs. services spending compare. I show this because real spending on goods has in the past declined months in advance of recessions, while real spending on services has frequently powered right through:

Real spending on goods rose 0.9% for the month, while real spending on services rose 0.4%. The former is up a whopping 18.3% compared with just before the pandemic, while service spending is up 5.3% since then. On a YoY basis, real spending on goods has been rising and is now up 3.3% while real spending on services is up 2.9%:

Although I won’t show the long term graph, a 2.8% YoY increase in real spending on services remains historically very strong.

Real spending on goods can be decomposed further into durable (blue) vs. non-durable (red) goods, showing that the bigger increase continues to be in durable goods:

My suspicion has been that the loosening of supply chain disruptions in motor vehicle production, and increased sales in the same, is what has been reflected in the big increase in durable goods consumer spending; and that suspicion once again seems vindicated.

With no increase in real income, but a big increase in real spending, the personal saving rate - income that isn’t spent - declined a very sharp -0.8% for the month to 3.5%, although it is still higher than its 2.7% level at its low water mark last June. The below graph subtracts 3.5% for a long term comparison:

With the exception of several months last year, and the 2005-07 lows, the personal saving rate is at its lowest level ever. This is leaving consumers quite vulnerable.

That’s important because consumers tend to get cautious and save more in the advance of a recession. That occurred in the last year, but it has completely reversed in the past two months. I am doubtful this will be sustained, but we’ll see.

Additionally, the personal consumption deflator gets used in the calculation of real manufacturing and trade sales, which is another important coincident indicator monitored by the NBER. These were unchanged in June, and are still -0.7% below their recent January 2023 peak, as well as their higher January 2022 peak:

Finally, the deceleration in the personal consumption deflator, which started with the peak in gas and commodity prices generally in June 2022, may have ended. YoY this deflator increased to 3.3% in July from 3.0% in June. The “core” deflator also increased from 4.1% to 4.2%:

Last month I summed up by writing that “If that tailwind [of YoY decelerating prices] is ending - and I suspect it is - what happens next?” This month provided more confirmation of that suspicion. I suspect the Fed will not be happy with these increases. If they respond by further raising rates, then without the tailwind of declining commodity prices the “soft landing” could come to a rather abrupt end, depending on how quickly the clogged housing and vehicle markets roll over.