- by New Deal democrat

No big new economic news today, so let’s take a more in-depth look at some of the information from Friday’s employment report. Today I’m going to focus on the division between goods and services.

As I’ve written many times in the past, consumption leads employment. Typically I have shown that via real retail sales. The variation I am going to use today is employing real personal spending on goods vs. services, and how consumption leads employment for each.

As a refresher, here is real personal spending on goods YoY (blue) vs. services (red), up until the pandemic:

Note that spending on goods is much more volatile than spending on services (in fact I’ve divided the result for goods by 1.5 so that services spending doesn’t just show up as squiggles). Most importantly, it tuns down YoY generally coincidently with the onset of recessions, whereas growth in services spending usually just decelerates. Also, while the two moved coincidently from 1960-90, since then spending on goods has usually led spending on services somewhat.

Here’s the same information since the pandemic (omitting the year of huge distortions):

Goods spending did fall below zero during much of 2022, and is only slightly above zero YoY now, while spending on services is much stronger.

Now let’s compare real spending on goods (blue) with employment in the goods sector (red) YoY, pre-pandemic:

With two exceptions (the mid 1980’s and late 1990’s) goods consumption leads goods employment. Note that this holds true even though due to globalization and offshoring, goods employment never rose nearly as much as goods consumption beginning with the 1980’s.

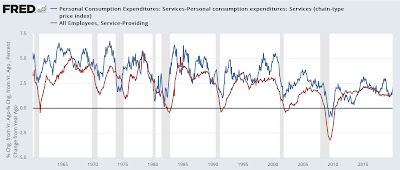

The same leading/lagging relationship holds true for consumption of services (blue) vs. employment in services (red):

Now let’s look at each post-pandemic. First, here is goods consumption vs. employment:

Goods spending recently peaked YoY in summer 2021, while as we should expect based on past history, goods employment did not peak until spring 2022. Goods spending rebounded somewhat as spending power increased with the decline in gas prices from $5 to $3/gallon in late 2022. Goods employment is still decelerating, and is only up 0.3% since February, or roughly at a 1% annual rate.

Here is services consumption vs. employment:

Both consumption and employment in the services sector have been much stronger than in the goods sector, and while both have been decelerating since the spring 2021 stimulus spree, consumption has decelerated faster compared with late 2021.

Since gas prices have been pretty stable this year, the tailwind for goods spending is subsiding. I expect goods spending to decelerate further YoY, and probably turn negative again, with goods employment following. My best guess is this will occur by the end of this year, possibly earlier.

As per past history, the deceleration in both consumption and employment in the goods sector is likely to be slower, but will follow goods spending and employment with lower growth if not an outright decline.