- by New Deal democrat

Initial claims rose sharply last week, up 28,000 to 261,000 (an 18 month high). The 4 week average rose 7,500 to 237,250, still lower than its April peak. Continuing claims, with a one week delay, declined -37,000 to 1.757 million:

When we had a similar spike a month ago, it turned out to be a artifact of mis-reporting by Massachusetts, so take this with a grain of salt until we have more clarity that it won’t be revised away.

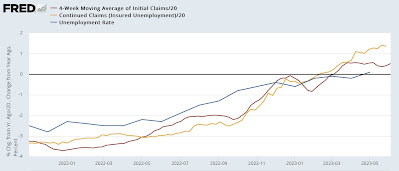

Nevertheless, with that caveat YoY weekly claims are up 18.1%. The more important 4 week average is up 10.3%, and continuing claims are up 27.1%:

As I wrote last week, continuing claims have never been this much higher YoY without a recession having already started. The 4 week average, having risen back over 10%, merits reinstatement of the yellow caution flag.

Here is an updated look, with this week’s data, of initial claims YoY vs. the unemployment rate (remember that the former leads the latter):

The implication is that the unemployment rate is likely to rise at least slightly more during the next several months.

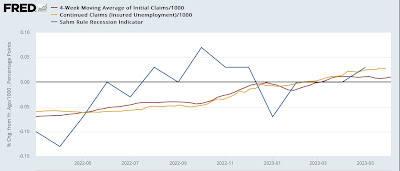

Finally, because the Sahm rule for recessions lags even the turn in the unemployment rate, both initial and continuing claims lead that as well (note: claims /1000 for scale)

The current Sahm rule value is +0.03; +0.5 is the trigger level, which typically occurs after a recession has already started. By that time the median YoY% increase for claims has been 20%+.

So, the yellow flag is reinstated; but it is only one week’s data. I would need to see the 4 week average higher by 12.5% or more for a full month before it triggers a recession warning. Which would include of course an implication of a significantly higher unemployment rate.