- by New Deal democrat

Programming note: I’ll put up separate posts on durable goods orders, real manufacturing and trade sales, and the Q4 GDP reports later.

Initial jobless claims have been the best performing - and perhaps only positive - element of the short leading indicators in the past few months. And that continued in this morning’s report.

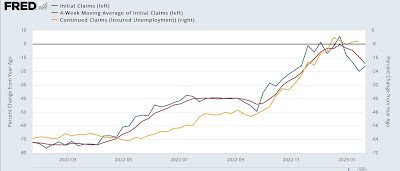

Initial claims declined -6,000 to 186,000, the lowest number since last April. The 4 week average declined -9,250 to 197,500, the lowest since last May. Continuing claims with a one week delay increased 20,000 to 1.675 million, still -43,000 below their recent high in December:

Only continuing claims were higher YoY. Initial claims, and more importantly, their 4 week average, were down YoY. Unless and until this number moves higher by at least 10% YoY, there is no recession warning:

In that regard, I’ve read some commentary indicating that a recession can’t start with initial claims so low. This is not really true, as there is no “magic number” of initial claims that correlates with recessions. Rather, past history indicates it is the *change* in initial claims which is the best indicator.

To show that recently, here are initial claims averaged monthly for the past year (blue) vs. job grains for the past year (light brown, right scale):

On a monthly basis, initial claims have varied between 180,000 and 245,000. But monthly job gains declined from over 700,000 to just over 200,000 during that same period. There would be no such huge decline in the number of jobs gained monthly if there were the claims big correlation between the number of initial claims and jobs.