- by New Deal democrat

Manufacturers’ durable goods orders, and in particular “core” orders, which exclude defense and transportation (a/k/a Boeing), are (albeit noisy) a short leading indicator. I normally don’t pay too much attention to them because of that noise, and because they are less reliable than other indicators; but until recently, they were one of the few positive short leading indicators remaining - so I have been interested in when they might roll over.

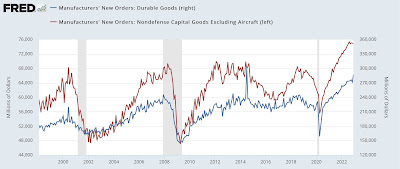

Here’s the long term look at each for the past 25 years:

To cut to the chase, while total durable goods orders rose 5.6% for the month, core capital goods orders declined -0.2%:

This isn’t quite “rolling over,” but on the other hand, core capital goods orders haven’t made a new high since August.

The bottom line is that they are basically neutral. At this point only labor market indicators remain positive for the near term economy.