- by New Deal democrat

Last month I highlighted that housing constructions was stabilizing, following the stabilization in interest rates. This month continued that trend.

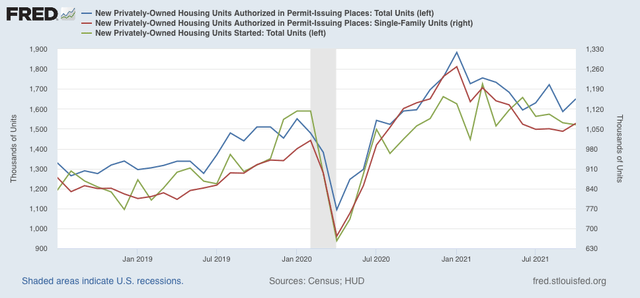

In October, housing starts (green in the graphs below) decreased -0.7% m/m, while the more leading total permits (blue) increased 4.0%. The less volatile single family permits (red) increased 2.7%. As a result, the overall trend for all three metrics for the past several months is generally flat:

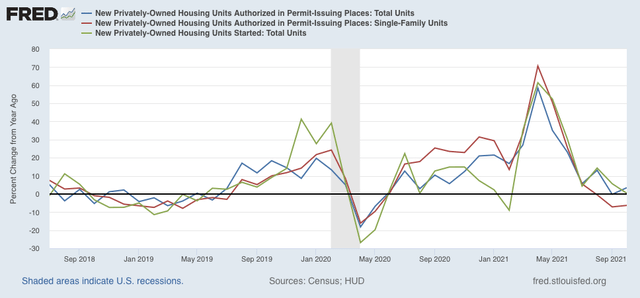

On a YoY% basis, starts are up 3.5%, permits barely up 0.4%, and single family permits down -6.3%:

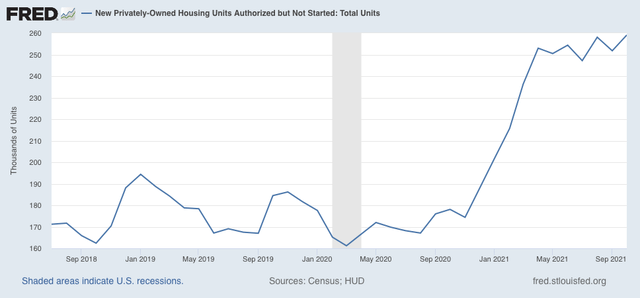

The YoY increase in starts continues to be noteworthy because it highlights an unusual event which has taken place over the past year; namely, a record number of permits were issued for houses that were not promptly started. Here’s a graph of such housing for the past 3 years:

The current level is the highest since the 1970s (not shown).

In other words, the actual on-the-ground economic activity in housing construction hasn’t declined that much, presumably because housing materials at reasonable prices constrained the actual building of houses authorized by permits. On a rolling 3 month average basis, housing starts are only down -4.4% from their year end 2020 peak. This suggests much less of a real economic downdraft than would otherwise be the case, as typically it has taken a downturn of about -20% to be consistent with a recession.

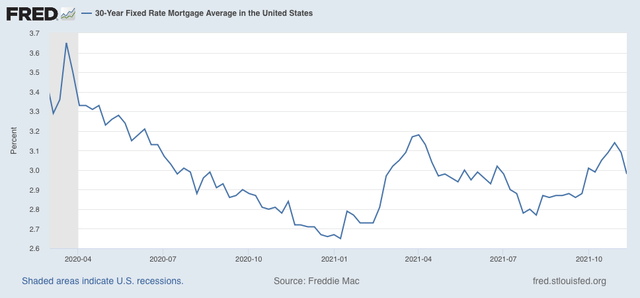

As I have repeated many times, interest rates lead housing construction. And the evidence from mortgage rates is that housing should be (and is) stabilizing. In the past 6 months rates have stabilized between the 2.75%-3.15%:

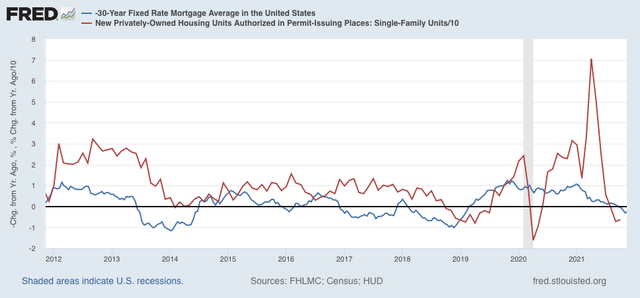

As a result, I would expect stabilization or a moderate increasing trend in response. This is shown when we compare the YoY% changes in mortgage rates (inverted) and single family housing permits over the past 10+ years:

In October, Mortgage rates only were increased 0.14% YoY, and for all intents and purposes have been flat YoY for the past 4 months.

Since housing construction is a long leading indicator, this series continues to suggest that the economy, after a period of cooling early next year, will also stabilize later on.