- by New Deal democrat

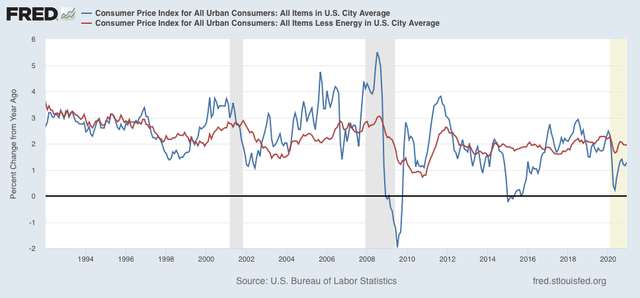

Consumer inflation typically rises as expansions continue, and declines once recessions start. Once a recovery begins, inflation typically steadies again. While the pandemic has affected both consumer demand and the supply chain, overall the paradigm should still apply. With that in mind, let’s take a look at December’s report.

For the past 40 years, recessions had typically happened when CPI less energy costs (red) had risen to close to or over 3%/year. As of this month that number is exactly 2%:

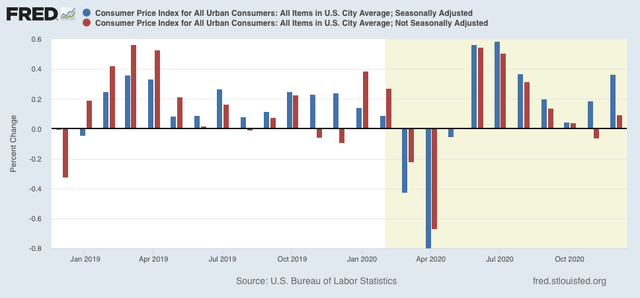

In other words, there is no troublesome price pressure outside of the pandemic. Because pandemic affects are probably influencing seasonality, I also show non-seasonally adjusted inflation below (red):

Typically inflation increases in the first few months of the year, and abates in the latter part. The unusual 0.4% seasonally adjusted increase for December appears to have been primarily driven by a 0.3% increase in food prices. I expect that price pressure to pass in the next few months.

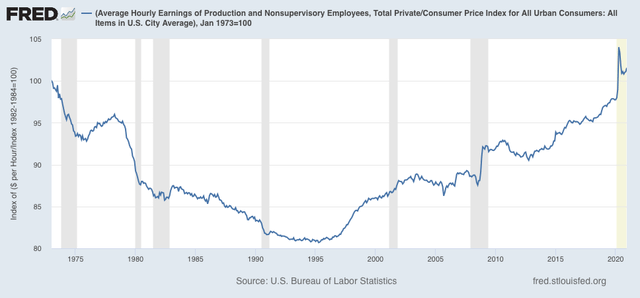

Now let’s take a look at how inflation has affected real wages. Because wages are “stickier” than prices, typically as recessions beat down prices (or at least price increases), in real terms wages rise, either during or just after a recession. That has been the case for the coronavirus recession as well. It is the “real” buying power of wages among those still securely employed during a recession that is one of the engines that usually restarts growth.

Also as a result, real hourly wages for non-supervisory workers have exceeded their previous 1973 peak by 1.6%:

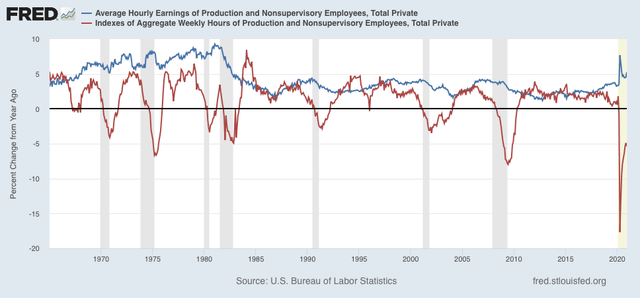

Finally, one of the most telling metrics of the overall health of the middle/working class is that of real aggregate wages. After declining -13.8% from February through April, they recovered to -3.1% below their peak in November, before declining -0.2% last month. Here is comparison of the YoY changes in average (blue) vs. aggregate (red) wages, showing the outsized upward skew in average wages vs. the huge hit to aggregate wages - even bigger than during the Great Recession:

While average wages have risen by over 5% in the past year - the best showing since the inflationary 1970s - this is due to compositional effects, as the pandemic has resulted in outsized layoffs to lower paid service workers.

What we want to see is the red line above zero, and the blue line at least not declining further. All of this is at the mercy of the course of the pandemic.