- by New Deal democrat

One of my big themes this year is that low gas prices can hide a multitude of economic sins. This morning’s data on personal income and spending confirms that the consumer side of the economic ledger is doing OK.

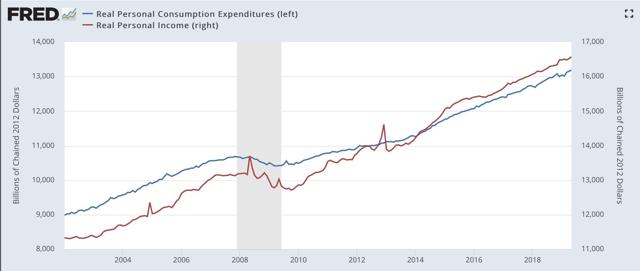

Nominal personal income rose +0.4%, and nominal personal spending rose +0.5%. After adjusting for inflation, the numbers are +0.3% and +0.2%, respectively. As a result, the positive trends for both continue:

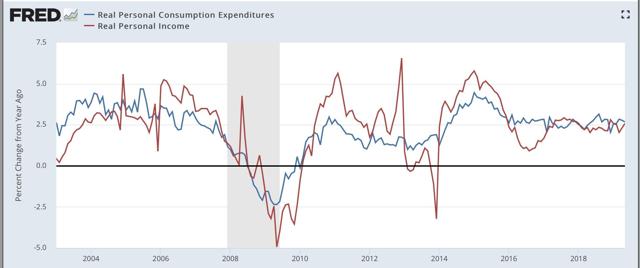

On a YoY basis, we can see that spending slightly leads income (similarly point to the way consumption leads employment, not the other way around), and is also more volatile:

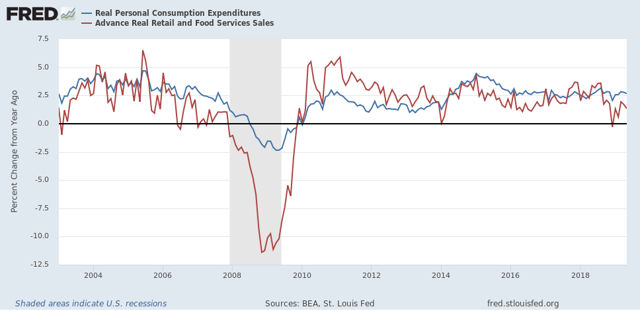

Next, going back 50 years, real retail sales improve further early in expansions, and fade more quickly later in expansions. Here’s the graph for that for the past 20 years:

The trend reversed for 12 months after the August and September 2017 hurricanes sparked lots of extra spending, but not the late cycle pattern has re-asserted itself.

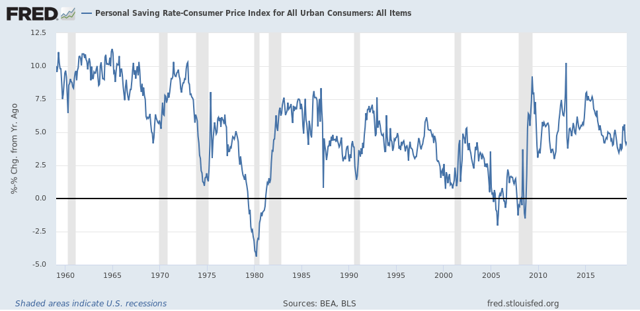

What isn’t spent is saved, and the personal savings rate adjusted for inflation generally declines substantially roughly midway through expansions, and then starts to turn up just before or early during recessions as consumers get more cautious:

What isn’t spent is saved, and the personal savings rate adjusted for inflation generally declines substantially roughly midway through expansions, and then starts to turn up just before or early during recessions as consumers get more cautious:

The former has happened. The latter really hasn’t, although it did briefly spike during the “mini-recession” caused by the government shutdown.

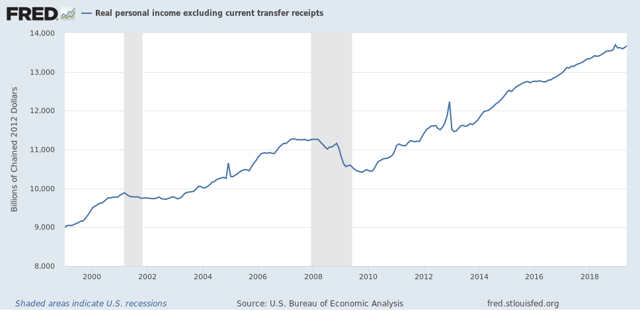

Finally, real personal income minus government transfer payments (e.g., food stamps) is one of the metrics the NBER uses to delineate recessions. Here’s what that looks like for the past 20 years:

Finally, real personal income minus government transfer payments (e.g., food stamps) is one of the metrics the NBER uses to delineate recessions. Here’s what that looks like for the past 20 years:

Again, this is still positive, although for the last 9 months there has been a significant deceleration to +1.0% (or +1.3% annualized).

So, to sum up, as to the consumer side of the economic ledger:

1. Lots of evidence of late cycle deceleration, but

2. No sign of rolling over at this point.

With low gas prices and somnolent inflation, 3%+ YoY wage gains are enough for the consumer to be doing alright. If there is a recession waiting in the wings, it will be producer-led similar to the dotcom bust of 2001.