Wednesday, April 5, 2023

One of the last of the positive short leading indicators rolls over

Tuesday, April 4, 2023

February JOLTS report shows further *relative* weakening in the jobs market

- by New Deal democrat

The February JOLTS report showed a weakening in almost all important trends.

Monday, April 3, 2023

Both manufacturing and construction continue to contract

- by New Deal democrat

As usual, we start the month with data on last month’s manufacturing activity, and the previous month’s construction activity. This month, both were negative.

Sunday, April 2, 2023

Weekly Indicators for March 27 - 31 at Seeking Alpha

- by New Deal democrat

I keep forgetting to put up this link on Saturdays, but you know where to find it: my Weekly Indicators post is up at Seeking Alpha.

The good thing about high frequency indicators is you can see what is happening with trends much more quickly than with monthly releases. The bad thing is that the drip-drip-drip can take forever!

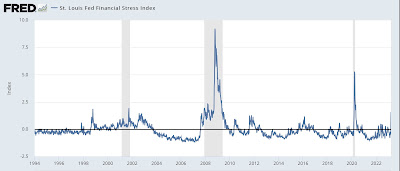

Anyway, the fallout from SVB continues in the credit sector; and corporate profits look like they might take a major hit in the Q1 reporting season, which starts in a couple of weeks.

If you haven’t already done so, clicking over and reading will bring you up to date, and reward me a little bit for organizing the data for you.

Friday, March 31, 2023

Real income in February rises slightly; real spending declines slightly; real total sales in January rose sharply, as expected

- by New Deal democrat

Thursday, March 30, 2023

Revisions to Q4 GDP made real final sales worse, a potential portent of near in time recession

- by New Deal democrat

A month ago, following another blogger, I took a look at real final sales, and real final sales to domestic purchasers, in the GDP - which increased less than 0.5% and just above 0% in Q4, and showed that in the past 60 years, only in the deep slowdowns of 1966 and 1987 were the numbers that low without having been followed within 1-3 quarters by a recession. Here’s a link to the full post from last month.

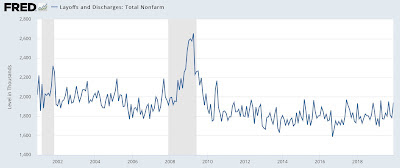

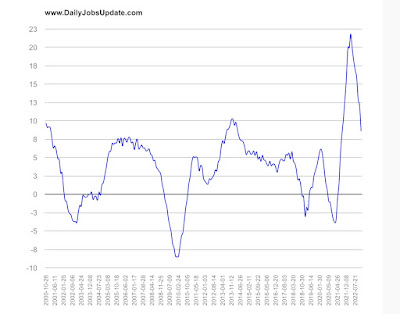

Almost nobody is still getting laid off, but this week, it’s not good enough

- by New Deal democrat

Today and tomorrow update the two remaining positive sectors of the economy: jobs and real personal income. And the first one continued to give excellent historical readings, but relatively speaking suffered in comparison to their all-time best readings from exactly one year ago.

Wednesday, March 29, 2023

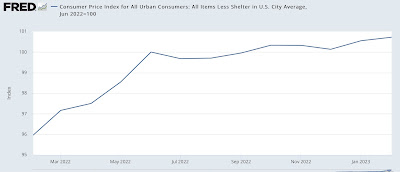

More on the sharp deceleration in YoY house price gains, and the Fed’s chasing the phantom menace

- by New Deal democrat

Since there is no big economic news again today, let me fill in a little more detail on house prices through January, reported yesterday, vs. CPI for shelter.

Tuesday, March 28, 2023

YoY house price gains continue to decline

- by New Deal democrat

Today is a travel day so I have to keep this brief.

Monday, March 27, 2023

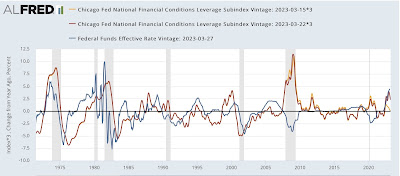

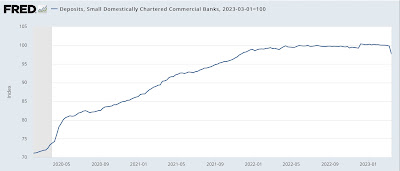

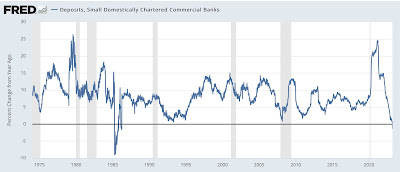

3 graphic signs of financial stress

- by New Deal democrat

The theme of my weekly “high frequency” economic indicators update over the weekend was the sudden deterioration in some measurements of financial stress.

It’s getting harder and harder to find any signs outside of employment that are not flashing warning signs of recession in the immediate future, if not already here.

Saturday, March 25, 2023

Weekly Indicators for March 20 - 24 at Seeking Alpha

- by New Deal democrat

I’ve neglected to put this up for the past several weeks, but by now you know where to find my latest Weekly Indicator post at Seeking Alpha.

Probably unsurprisingly, in the week after the Silicon Valley Bank failure, just about every financial stress indicators suddenly spiked. In other words, credit conditions, which had already tightened by the end of last year, tightened a lot more in the past several weeks.

Like I wrote yesterday, there are only a couple of things still holding up the economy from falling into recession. As usual, clicking over and reading will bring you up to the moment, and reward me a little bit for putting in the effort.

Friday, March 24, 2023

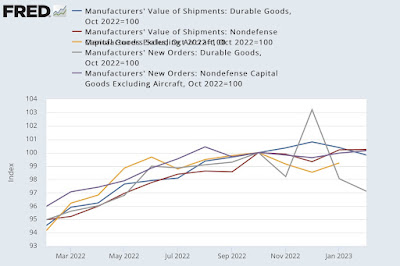

There is now only one significant manufacturing datapoint that is not flat or down - but it’s the one the NBER relies upon

- by New Deal democrat

I am increasingly of the opinion that at the moment, the only two economic data series that are important are nonfarm payrolls and the personal consumption expenditure deflator. That’s because almost every other important metric of the economy is either flat or declining. But payrolls keep chugging along (as evidenced by yesterday’s initial claims report showing that layoffs are figuratively non-existent). And the PCE deflator, which covers a broader spectrum than the CPI, keeps helping two coincident indicators important to the NBER, namely real personal income and real manufacturing and trade sales, remain in the plus column.

Thursday, March 23, 2023

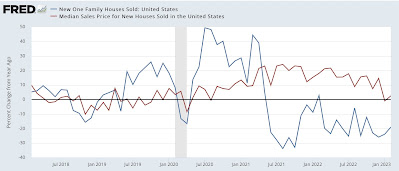

New home sales for February increase; likely bottomed last July

- by New Deal democrat

Most of what you probably read elsewhere focuses on new home prices, which after finally declining -0.7% YoY in January, rebounded to +2.5% YoY. As is usual, prices follow sales YoY with a considerable lag (note since prices are not seasonally adjusted, this is the right way to make the comparison):

Nope; nobody is still getting laid off

- by New Deal democrat

Initial jobless claims declined -1,000 to 191,000 last week, while the more important 4 week moving average declined 250 to 196,250. Continuing claims, with a one week delay, rose 14,000 to 1.694 million:

Wednesday, March 22, 2023

Updating 3 high frequency indictors: no recession yet, but no paucity of yellow flags

- by New Deal democrat

Tuesday, March 21, 2023

February existing home sales confirm prices have declined, but bottom in sales and construction may be in

- by New Deal democrat

There were only two noteworthy takeaways from the February existing home sales report:

Monday, March 20, 2023

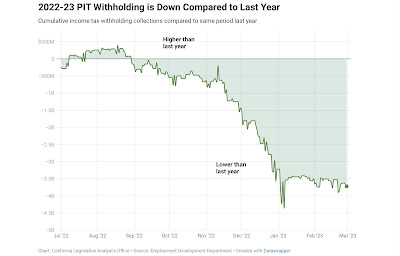

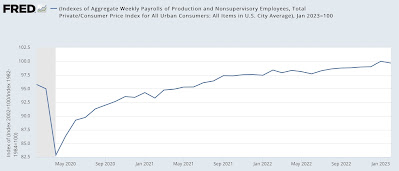

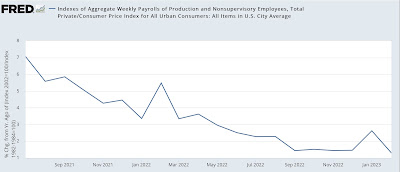

Average and aggregate nonsupervisory wages for February

- by New Deal democrat

There’s no significant economic news today, so let’s update a couple of income indicators important to average American working households. Namely, because we now have the inflation report for February as well as payrolls, we can update average and aggregate nonsupervisory wages.