- by New Deal democrat

New economic data will resume tomorrow. Since I haven’t updated the impact of Tariff-palooza! on transport and spending in awhile, let’s take a look at that.

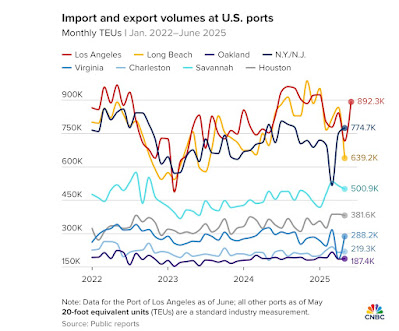

The “tip of the spear” is container shipping. Here’s a graph of traffic at the busiest ports in the US, from CNBC:

At the busiest ports, the steep decline this spring after a period of front-running is evident. In the past few weeks, there has been a rebound, doubtless in part caused by the TACO delay in tariff implementation. With the current “Liberation Day 2.0” set for August 1, a similar dynamic may well be in play.

Once containers arrive in the US, they are typically shipped long distances by rail. Here is the historical record of monthly intermodal volumes through June, measured YoY to deal with seasonality:

Again, the slowdown this spring is apparent.

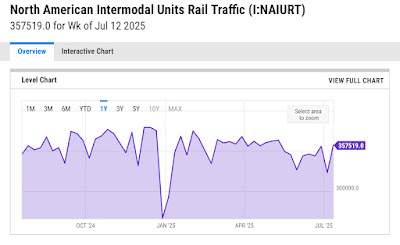

Here is a weekly close-up of the past year:

Much like shipping traffic, there has been a rebound so far in July, which may very well represent front-running the August 1 deadline.

Finally, here is YoY weekly consumer spending from Redbook, updated this week:

Again, we can see graphic evidence of front-running in February and particularly in the earlier part of April, which has now leveled off. The YoY nominal gain of just over 5% so far in July is very similar to the YoY gain last July. In short, there is no evidence of a consumer slowdown at this point.

In sum, the evidence of the past several months is that the economy has held up, in large part due to the delay in implementation of many of the tariffs. We’ll see what happens if implementation actually goes forward in August.