- by New Deal democrat

In the paradigm popularized by Prof. Edward Leamer 20 years ago, motor vehicle sales are the 2nd domino to fall, after housing, in the procession of sectors that turn down prior to recessions.

I haven’t updated this in awhile, so let’s take a look.

As an initial matter, the cycle in this sector was particularly hard hit by supply chain kinks during the pandemic, as electronic parts in particular were not produced at nearly a fast enough rate to allow full-scale production. This was a major reason why the prices of motor vehicles rose 20% since just before the pandemic by 2023:

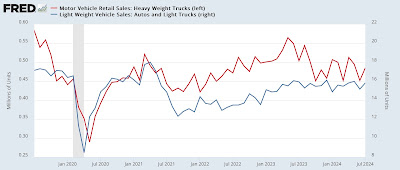

Turning to history, I’ve noted many times before that sales of heavy trucks (red, left scale) tend to turn down first, and much less noisily, than passenger vehicle sales (blue, right scale) before recessions:

In general, sales of heavy weight vehicle must turn down at least -10% on a consistent basis to be consistent with an oncoming recession. The below graph captures the essence of this by measuring the YoY% change in both passenger and heavy truck sales, averaged quarterly to reduce noise, and adding 10% so that the dividing point shows at the zero line:

Sometimes both light vehicle and truck sales are down -10% before recessions, and sometimes heavy truck sales are down much more while passenger vehicle sales are treading water.

For our present situation, here is the post-pandemic close up on absolute numbers:

Truck sales did decline over -10% last year, coincident to the bankruptcy of a major hauler, Yellow Truck. Passenger vehicle sales are still holding steady.

Now here is the YoY% look, monthly, again adding 10% so that the crucial cutoff appears at the zero line:

Heavy truck sales have flirted with the -10% level for the last 10 months. If they remain at their current level for several more months, the YoY comparison will be unchanged. Passenger vehicle sale remain steady.

The bottom line is that motor vehicle sales have not given, and are not now giving, any recession signal.