- by New Deal democrat

The JOLTS report for May showed most metrics continued to show a slight rebounding from their March lows. The overall picture for now appears to be one of stabilization, consistent with the fabled “soft landing.”

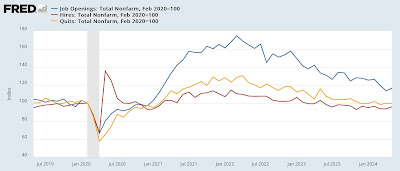

To the data: job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, rose 221,000 from its downwardly revised post-2020 April low to 8.140 million (vs. a pre-pandemic peak of 7.594 million). Actual hires (red) rose 141,000 from their second-lowest post-2020 level to 5.756 million (vs. a pre-pandemic peak of 6.0 million). Voluntary quits (gold) rose 7,000 from downwardly revised near-post 2020 lows in April 3.459 million. In the below graph, they are all normed to a level of 100 as of just before the pandemic:

For the past six months quits have been essentially even with their pre-pandemic levels, and for the past eleven months hires have been below those levels.

A similar situation remains the case with layoffs and discharges (blue in the graph below), which increased sharply from their 12 months low in April to 1.654 million, but continue to run roughly 20% below the level they had been at *any* point before the pandemic, and well within their overall flat trend for the past year:

The more leading weekly initial jobless claims (red), which have increased signficantly in the past month, suggest that layoffs and discharges may similarly increase out of this trend in the next several months.

Finally, the quits rate was unchanged at 2.2% for the seventh month in a row. I won’t bother with the long term graph this time around, but since, as I have noted for a number of months now, the quits rate (blue in the graph below, right scale) tends to lead average hourly earnings (red), this suggests that the deceleration in nominal wage growth may come to an end in upcoming months - which overall is probably a positive:

My big concern over the past year has been if a further deceleration in wage growth were to coincide with an upturn in inflation, because that would likely cause a decline in real consumer income and spending. Thus if the rate of wage growth is stabilizing, this is a good thing for workers, especially if inflation continues to gradually subside.