- by New Deal democrat

Consumer prices in June failed to show any inflation at all for the second month in a row, as they declined -0.1% following an unchanged reading in May. On a YoY basis inflation decelerated -0.3% to 3.0% (technically 2.98% if you go out one further decimal point), the lowest YoY increase since March 2021.

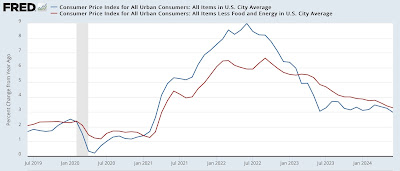

For the record, “core” inflatioin less food and energy increased 0.1%, the lowest monthly increase since January 2021. On a YoY basis it was higher by 3.3%, the lowest since April 2021. Here is the YoY% change in both headline (blue) vs. “core” (red) inflation:

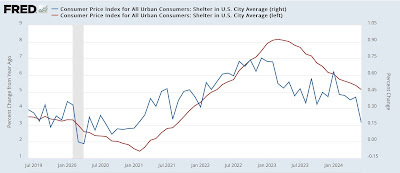

As usual, the price of gasoline and the imputed price of shelter were the primary components, as energy declined -2.0% for the month, while shelter increased 0.2%, the lowest monthly increase in that component since February 2021. Here are the monthly (blue, right scale) and YoY (red, left scale) % changes in the shelter index:

On a YoY basis, imputed shelter inflation was 5.1%, the lowest since March 2022.

Shelter has continued to behave just as I expected. Here is an update to the 12-18 month leading relationship between house prices (as measured by the FHFA) and Owners’ Equivalent Rent in the CPI:

House prices are currently increasing a little higher than their average pre-pandemic rate (because, ironically, the Fed’s rate hikes have exacerbated a shortage in housing supply, thereby driving up its price), which has translated to OER and the other measures of shelter inflation to continue to decelerate YoY, but at a much slower pace than their initial rapid decline. I expect this trend to continue in the coming months.

When we strip out shelter, all other items declined -0.1% for the month, again after being unchanged in May, and are only up 1.8% YoY - the 14th month in a row they have been up less than 2.5% YoY:

In other words, properly measured, inflation continues not to be a problem at all.

Before I finish, let’s take an updated look at our recent and former problem children, starting with new and used vehicle prices. The former were unchanged in June - the 10th time in 11 months they were unchanged or actually declined, while the latter declined another -1.5%. On a YoY basis both are in outright deflation, as new car prices are down -0.9% and used vehicle prices are down -9.5%:

Since just before the pandemic, new vehicle prices are up 20.4% and used vehicle prices are up 27.2%. Meanwhile average hourly wages for nonsupervisory personnel are up 25.7%:

While car prices may still seem shocking, the fact is that wages have almost completely caught up.

Here’s what happened with the remaining problem areas of inflation:

(1) food away from home, which peaked at 8.8% YoY over one year ago, increased 0.4% again in June, and increased 0.1% (actually 0.03% one decimal point further) on a YoY basis to 4.1% i, vs. its pre-pandemic average of 2.5%-3.0%:

(2) electricity, which had followed gas prices higher, appears to be starting to follow them lower, declining -0.7% in June, and has decelerated to a 4.4% YoY gain:

(3) transportation services - mainly car repairs (up 0.2% for the month, but down from its peak of. 14.2% YoY in January 2023 to 6.0%) and insurance (up 0.8% for the month and up 19.5% YoY - still down from April’s 22.6% YoY gain) - declined-0.5% for the second month in a row. It had rocketed from its pre-pandemic range of 2.5%-5.0% to as high as 15.2% in October 2022, but has since decelerated to a gain of 9.2% YoY:

Based on the past inflationary period of 1966-82, it is clear that transportation services lags increases in vehicle prices by 1-2 years and even more, sometimes increasing right through recessions.

To sum up: aside from shelter and transportation services, *no* sub-sector of prices was up more than 4.4% YoY. Many measures, including headline and core measures, made new 3 year lows YoY. And inflation ex-shelter continued well under control.

On final important comment: the Fed tolerated a number of years where inflation was up to 1% below its target of 2% with complete equanimity. Now that YoY inflation is marginally under 3%, a Fed with symmetric preferences would be equally comfortable, and open to lowering rates. The suspicion before the pandemic was always that the Fed treated 2% inflation more as a ceiling than a target. Given recent signs of weakening in some sectors, and the fact that Fed policy takes a long time to reach full effect, my personal opinion is that this report gives the Fed has the cover it needs, if it chose to, to lower rates at its meeting later this month. If it doesn’t, that suggests that its preferences are in fact asymmetric - and in the more dangerous deflationary direction.