- by New Deal democrat

Construction spending for October was reported last Friday, and every sector but nonresidential ex-manufacturing showed increases:

Total spending was up 0.6%, residential a sharp 1.2%, and manufacturing 0.9%. Only nonresidential ex-manufacturing declined, by less than -0.1%.

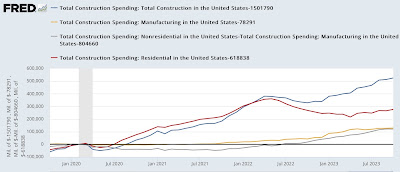

The big increase in manufacturing construction due to the Inflation Reduction Act, which has encouraged re-shoring, has helped keep total construction spending positive. But so has other non-residential construciton, as shown by this graph which norms each category to zero just before the pandemic:

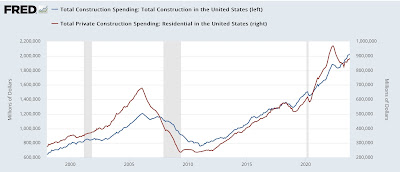

On a YoY basis manufacturing is the star of the show. But note from the historical graph that residential construction previously has turned down first, with manufacturing and other non-residential construction lagging (likely because of long lead times and the extended duration of completing projects):

But as the first graph above shows, on an absolute scale manufacturing construction has been a secondary player except for the period between December of last year and May of this year, in which it accounted for almost 2/3’s of the entire gain. Since then, residential construction improvement has again moved to the fore.

Historically residential construction spending has moved generally on a coincident basis with the number of building units under construction (except that the former, of course, is affected by inflation):

The decline in building costs (gold, below) helps explain why residential building construction has not just held up, but actually increased even as a big increase in mortgage rates has caused a big decline in permits and starts:

And the fact that construction spending has improved so much is a big reason why the economy has continued to expand. With manufacturing less of a factor overall, construction is a bigger pard of the goods-producing part of the economy. Unless and until construction rolls over, therefore, it is unlikely that the economy as a whole will roll over as well.