- by New Deal democrat

This is the topic I indicated last week I wanted to write about more at length. Paul Krugman wrote last week about the disconnect between most economists, who see inflation declining, and voters, who still see inflation as a major concern. Here’s a couple of his tweets:

As I wrote last week, the “shrinkflation” in new homes is very much a part of why the public continues to believe that inflation remains a big problem. So let me elaborate a little more.

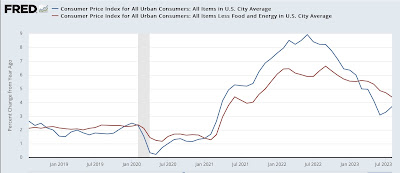

As an initial matter, Krugman is absolutely correct that the official measures of inflation are abating, as shown in the below graph of YoY headline and core inflation:

More importantly, when we eliminated fictitious shelter inflation, everything else has risen only 1.0% YoY. And measured by home prices, as we saw yesterday, shelter prices have only risen about 1% YoY as well:

So “inflation” as economists look at it, i.e., the change in prices, is clearly abating.

But consumers don’t just look at price changes like the above, or even price changes as compared with wages. Because there are at least two big expenses - houses and cars - that aren’t just purchased out of pocket, but rely on changes in wealth as well.

And that I suspect is where voters’ perceptions are coming from.

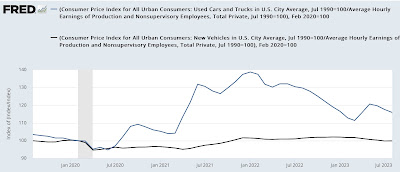

For example, when we look at the prices of new and used vehicles compared with wages, we see that new cars cost no more compared with wages than they did before the pandemic. Both have increased by about 20%; and indeed the long term view shows that new vehicles cost less than they typically did as a share of wages over the past 30 years. Used vehicles, on the other hand, still do cost about 15% more:

But most people finance their vehicle purchases. And interest rates on vehicle loans have risen from roughly 5% to 7.5%:

So the monthly payment for a new car is about 50% higher than it was before the pandemic, and for a used vehicle it’s about 80% higher (1.2*1.5). If I am calculating my monthly car payment in how I look at inflation, that’s a big increase.

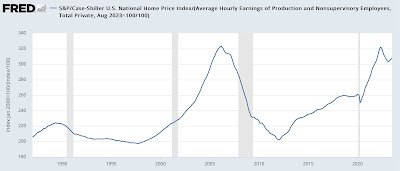

The situation is even more stark when it comes to housing. Compared with wages, house prices are still 15% higher than they were before the pandemic:

On top of that, as I wrote yesterday, mortgage rates at 7.5% are now 2.5* higher than they were at 3%. So the total monthly payment for a new house is nearly 3x as much as it was in 2019.

In other words, to summarize: the two biggest purchases made by most people have gone up about 80% and 200%, respectively. From the viewpoint of their monthly payment, inflation is a huge problem - despite officially rising less than 3%.