- by New Deal democrat

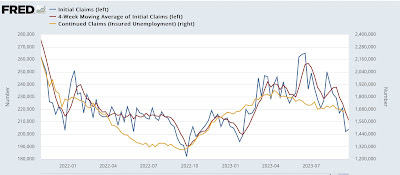

Initial jobless claims rose 2,000 last week to 211,000. The 4 week moving average declined -6,250 to 211,000. With a one week lag, continuing claims rose 42,000 to 1.670 million:

Although this appears very strong on an absolute scale, we had a very similar sharp decline to new 50 year lows last September as well, which make me think that there is some unresolved post-pandemic seasonality in play.

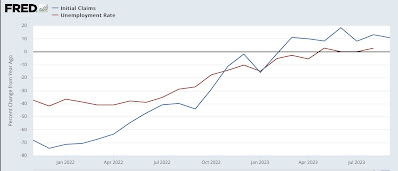

On the YoY% basis more important for forecasting, initial claims were up 12.1%, the 4 week average up 10.8%, and continuing claims up 29.5%:

While this indicates weakness, it does not cross the 12.5% threshold which would suggest a recession is likely.

On a monthly basis, so far in September initial claims are up 10.8%. Since initial claims lead the unemployment rate by several months, this implies that the average unemployment rate by the end of this winter is likely to be approximately 4.0% (i.e., one year ago the average unemployment rate was 3.6%; 3.6*1.108 = 4.0):

Again, this suggests a weakening of the jobs market ahead, but does not yet indicate a recession in the immediate future.