- by New Deal democrat

As usual, we start the month with new manufacturing and construction data.

The ISM manufacturing index goes all the way back to the 1940s, and has been a very good short leading indicator of recession throughout that time (although nothing’s perfect!). However, since the “China shock” started 20 years ago, with so much offshoring of manufacturing, it has less weight both for the economy as a whole, and for the percentage of people employed in the sector. Thus it carries less weight now than it did before. In particular, several times in the past 10 years it has been at recessionary levels without any broad based turndown spreading beyond manufacturing.

So far, the same has been true this year. In June, the overall index declined another -0.9 to 46.0 (any score below 50 indicating contraction. The more leading new orders index improved, in the sense of getting less bad, rising from 42.6 to 45.6 - meaning continued contraction, but at a slower pace:

These continue to be plainly recessionary numbers for the manufacturing sector.

The issue remains, how much will the weakness spread?

Some indication is given by this morning’s other report, for May: construction spending.

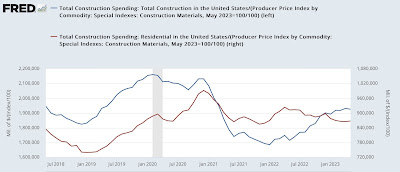

On a nominal basis, total spending rose 0.9% from April. The more leading residential construction spending rose 1.5% nominally for the month, but this was after steep downward revisions for earlier months:

But, the cost of construction materials rose 1.2% in May, meaning that inflation-adjusted total spending actually declined -0.3%, and real residential construction spending only rose 0.2%:

The bottom line is that both sectors continue to pull downward on the US economy, which is increasingly being buoyed by services spending, which is a coincident but not leading sector.