- by New Deal democrat

As usual, we start the month with reports on last month’s manufacturing, and construction from two months ago.

The ISM manufacturing index has a 75 year record of being a very reliable leading indicator. According to the ISM, readings below 48 are consistent with an oncoming recession. And there, the news is not good. Not only has the index been below 50 for the past 6 months, it has been below 48 for the past 5, even though in April it rose from 46.3 to 47.1. Just as bad, the new orders subindex, which is the most accurately leading component, has been in contraction since last summer, although it too rose in April from 44.3 to 45.7:

Needless to say, this indicator has been forecasting and continues to forecast recesion.

Construction was mixed, but the most leading component continued to contract as well. Total construction rose 0.3% nominally in March, but only after February was revised significantly downward. But residential construction spending declined -0.2%:

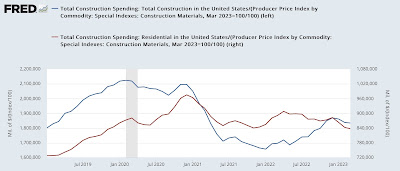

For the past several years, I have been adjusting the nominal numbers by the PPI for construction materials. This had been declining, but rose 0.5% in March, which means that the deflated number for total construction declined, and that for residential construction declined even more:

Not an auspicious start to the month; with the significant caveat that these two sectors make up less of the economy than they used to several decades ago, and as we saw last Friday, consumer spending on services, while decelerating, remained historically strong.