- by New Deal democrat

This morning’s JOLTS report for January, unlike the recent payrolls report, generally showed further softening in the labor market.

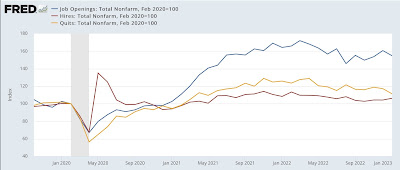

While hires (red in the graph below, normed to a value of 100 as of February 2020) increased 121,000, quits (gold) declined 207,000, and openings (blue) declined 410,000:

The downward trend in quits is most noticeable. Since employees voluntarily quit more, the more confident they are about new job prospects, this is a clear sign of *relative* weakening. The increase in hires is more a flattening of the trend, which had been decelerating. The trend in openings does appear to be softer, although given the increase in the last few months before January, that is more questionable.

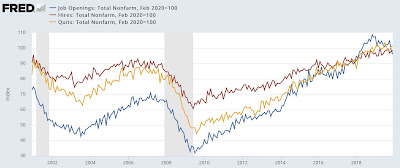

For comparison purposes, here is the same graph covering the period since the inception of the series through 2019:

Note that all three appeared to be weakening just before the 3 recessions since 2000; but openings have continued to increase on a secular basis. That businesses may have been maintaining job postings even when they were not actively looking, but just to troll for resumes; and further that that behavior has probably been spreading throughout industry; is one reason why I do not place as much value in this series as I do in others. Still, the overall trend is useful evidence of the status of the jobs market.

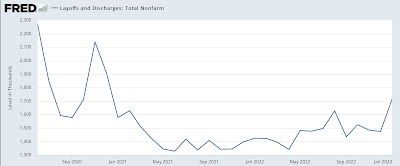

Finally, layoffs and discharges increased sharply, by 241,000, in January, to their highest level since October 2020:

Here is their record before the pandemic:

Note that the current level of layoffs and discharges would be very good for any period since 2000 up until the pandemic hit.

To summarize: the January JOLTS report is most consistent with a continued very strong labor market, but one which is softening in comparison with even stronger levels during 2021-22.

A weakening of this report, particularly as to job openings, is one of the main indicators I have been looking at for evidence that broader employment metrics are beginning to capitulate. I don’t think this report puts us there in any meaningful sense. Still, in Friday’s employment report I will be focusing most intently on whether employment in three leading sectors - temporary jobs, manufacturing, and residential construction - has either continued negative (as to the first sector) or turned negative (as to the last two).