- by New Deal democrat

We started out yet another month of data with bad news in two leading sectors.

The ISM manufacturing index has been showing contraction since November, and its more leading new orders subindex since September. And did so again in February, with the total index increasing slightly to 47.7, and the new orders index rebounding from a horrible 42.5 to 47.0. But because both of these numbers are below 50, they still show contraction:

In the past, the ISM has said that numbers below 48 have been most consistent with recession.

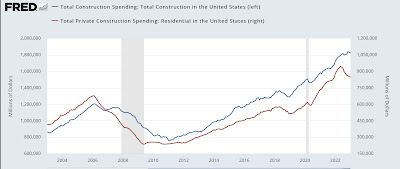

Meanwhile, construction spending for January also declined by -0.1%, and the more leading private residential construction spending declined by -0.6%:

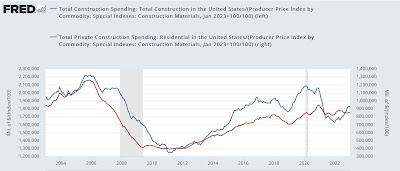

Even after factoring in the prices for construction materials, which declined -0.1% in January, “real” residential construction spending declined -0.5%:

Finally, in a bit of relatively good news, it appears that the crunch in motor vehicle production may have eased somewhat, as in January 15.7 million autos and light trucks were sold on an annualized basis, the highest number since June of 2021 (the below graph norms that to 0 to better show comparisons):

A more typical expansionary reading before the pandemic would have been between 17.0-18.0 million units annualized, so this is still a shortfall, but is much closer to a normal range than we have seen in the past year.

When February payrolls are reported a week from this Friday, the leading sectors of manufacturing and construction jobs, neither of which has turned down as of now, will be of special importance.