- by New Deal democrat

The first data for the month of January is in, and with one exception, it is pretty bad.

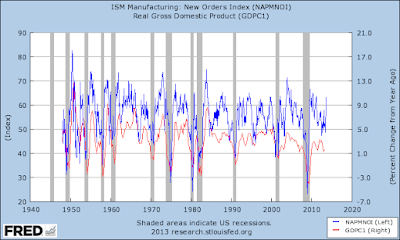

The ISM manufacturing index declined -1.0 to 47.4. According to the ISM, 48 is the cutoff below which is more consistent with a recession. Even worse, the new orders subindex cratered, falling 2.6 to 42.5:

Going back 75 years, the *only* time that new orders have been this low and a recession did not occur was in the middle of the Korean War:

This highlights focusing on the change in manufacturing employment, which has yet to turn down, when nonfarm payrolls is reported this Friday.

Construction spending for December was also reported, with a decline of -0.4% overall (blue), and a decline of -0.3% in the more leading residential construction sector (red):

The one caveat to this negative news is that the PPI for construction materials declined -1.1% in December, meaning that “real” construction spending increased. Below I show the YoY% change in residential construction spending (blue) vs. the PPI for construction materials (gold):

Note that, generally speaking, the cost of materials follows the change in construction with a lag. We’ve had the housing boom; now we are in the beginnings of a housing bust.

Again, I’ll be watching to see if there is a decline in construction employment of Friday.

The December JOLTS report was also posted this morning. I’ll deal with it separately tomorrow, but note that it, unlike the other reports, was pretty positive, with a positive reversal in job openings in particular. Contra that, ADP’s private payrolls number for January reported this morning was the lowest in over a year at only +106,000. Again, on my list for special focus on Friday is whether the deceleration in the three month average of employment gains since early last year continues.