- by New Deal democrat

When the negative print on Q1 GDP first came out three months ago, I wrote:

“yes, it was a negative GDP print. No, it doesn’t necessarily mean recession…. But the big culprits were non-core items. Personal consumption expenditures, even adjusted for inflation, were positive. The three big negatives were a big decline in exports vs. imports, followed in about equal measure by a decline in inventories and a downturn in defense production by the government.”

Lo and behold, the above is almost equally true about Q2 GDP! Here’s the helpful graph summary from the BEA in the official release:

Lo and behold, the above is almost equally true about Q2 GDP! Here’s the helpful graph summary from the BEA in the official release:

I’ve also included the first bullet point explaining the inventory issue, which was the big negative in the report. Net exports minus imports wound up being a positive. Government spending was again negative, but this time was led by non-defense spending as, unsurprisingly, defense spending ramped up. The big negative addition was the big downturn in housing spending, about which I’ll have more to say later.

But I’ve made the point previously that the current expansion is very similar to the first two “Boom” expansions following the end of WW2. There was lots of inflation, but little change in interest rates. In fact, the Fed sat completely on the sidelines. It was when the “Bust” kicked in, as consumers were temporarily locked out of making durable purchases, that (shallow) recessions kicked in.

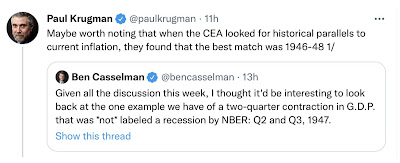

In fact, as Menzie Chinn wrote earlier this week, and Paul Krugman notes this morning, there were 2 consecutive quarters of negative real GDP in 1947, but no recession:

And Ben Casselman’s originating tweet points out that the negative and positive contributions to GDP at that time were very similar to the situation now:

My usual discussion of the long leading indicators in the GDP report will follow later.