- by New Deal democrat

With November’s consumer inflation report in the books, let’s update two of my favorite measures of how the working/middle class is doing - real average non-supervisory wages, and real aggregate payrolls.

Nominal average wages for non-supervisory workers rose a strong 0.7% in November. Inflation fell sharply to 0.1%. So real average wages rose 0.6% last month. Still, they are down -1.2% YoY, and down -2.2% since December 2020; but 1.9% higher than they were in January 2020 just before the onset of the pandemic:

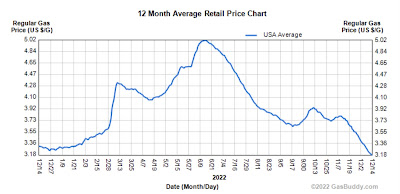

The recent inflection point, as I pointed out yesterday, was in June; and the below graph of gas prices tells you just about everything you need to know:

With gas prices down almost $2/gallon from 6 months ago, putting 15 gallons of gas in your vehicle costs you almost $30 less than it did then, which can improve a heckuva lot of statistics.

Next, real aggregate payrolls for non-managerial workers measure how much wealth the middle/working class is earning as a whole. In the past 60 years, when that has outright declined on a YoY basis, it has almost always coincided, give a month or two, with the onset of recessions, so it is an excellent coincident indicator as well:

In November, aggregate payrolls increased 0.6%, so real aggregate payrolls increased 0.5%. YoY they were up 1.6%:

To signal an imminent recession, nominal payroll growth would have to decelerate significantly more than inflation. So long as gas prices keep declining, it is very unlikely that will happen. Good news for now.