- by New Deal democrat

I have to keep this note brief, since I am on the road.

As you presumably already know, real GDP was positive for the Third Quarter, up 2.6% at an annual rate:

Subject to revisions in the next several months of course, but for the moment, this puts to rest ideas that the US economy was in a recession earlier this year, since the decline was very shallow and not across all important indicators.

The news on the leading components of GDP was mixed.

Proprietors’ income, a proxy for corporate profits, which won’t be reported for another month, were up 1.5% (blue in the graph below). The “official” leading metric uses unit labor costs as a deflator, which we also don’t know yet. But if ULC are in line with the past several quarters (red), real proprietors’ income was probably flat:

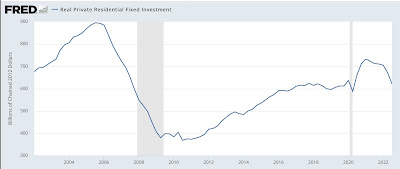

Finally, real private residential investment, the was housing is included in GDP, took a bad hit:

Housing is just about screaming “incoming recession!” at this point.

So: good news for the present, bad news for the near future.

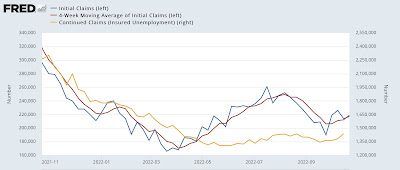

While I’m at it, here’s this week’s update on jobless claims:

No big move here. No real deterioration, but no improvement either.