- by New Deal democrat

As usual, the new month’s first data is for manufacturing and construction. Here’s a look at each.

The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. In August, after two months of showing slight contraction, the leading new orders subindex improved to 51.3, indicating expansion. The overall index also continued to show expansion, with a reading of 52.8 for the second month in a row:

This index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession, and in three cases did not actually cross the line until the first month of the recession itself - although the recession did not begin until after the total index fell below 50, and in fact usually below 48.

This print means we are not out of the woods, but on the other hand aren’t in a recession now.

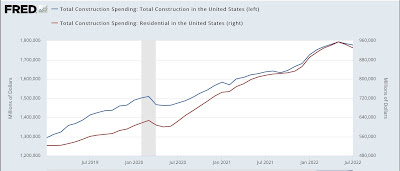

Turning to construction for July, the report indicates a nominal decline of -0.4%, although June’s original - 1.1% decline was revised to only -0.5%. The more leading residential sector declined -1.5%, although June’s original -1.6% decline was revised higher to -1.1%:

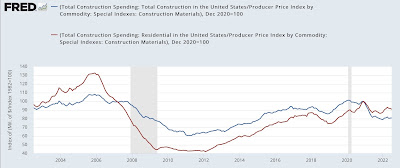

Adjusting for price changes in construction materials, which declined -0.6% for the month, “real” construction spending actually increased +0.1% m/m, and residential spending fell -0.9% m/m. Here is what “real” construction spending looks like for the past several years:

The decline in residential construction spending, while substantial, is less than its 2018-19 decline, and was nowhere near the -40.1% decline it suffered before the end of 2007.

While residential construction spending lags other housing data, such as permits, starts, and sales, it has the virtue of being much less noisy. Over a period of several months, it is almost pure signal. And what this tells us is - unsurprisingly at this point - the housing decline is real, and will likely be reflected as a negative component of Q3 GDP.