- by New Deal democrat

In case for some reason you haven’t already heard, the inflation news for June was uniformly bad.

Here is some of the carnage. For the month of June only:

- overall inflation was up 1.3%, the highest monthly increase since 2005

- energy inflation was up 7.5%

- inflation less energy was up 0.7%

- inflation in used cars and trucks was up 1.6%

- inflation in rents was up 0.8%, the highest since 1986

- owners’ equivalent rent, the CPI euphemism for house prices, was up 0.7%

Again, those were for the month of June *alone.* There was no respite anywhere.

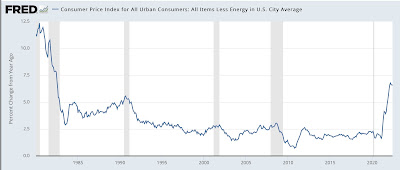

YoY, overall inflation was up 9.0%, the highest since 1981:

YoY energy prices were up 41.5%, the highest since 1980:

YoY prices less energy were up 6.6%, which is below the March peak of 6.8%, but still above any year previous since 1982:

The relatively bright spot is that YoY prices in used cars and trucks were “only” up 7.1%, compared with their June 2021 peak of +45.3%:

YoY rents increased 5.8%, the highest since 1986, and owner’s equivalent rent (red)(for houses) increased 5.5%, the highest since 1990. As I have been saying for 9 months, house prices (black) lead OER by 12-18 months, meaning we were likely to see the highest YoY% increases in OER ever. And we are well on our way:

I am sure everyone is expecting another 0.5% hike, if not a 0.75% hike, at the next Fed meeting.

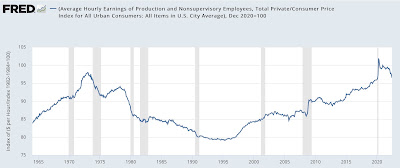

Finally, this absolutely clobbered real wages in June. Average hourly earnings for nonsupervisory employees increased 0.5% in June, but with a 1.3% increase in consumer prices, real average hourly wages decreased 0.8% for the month. Real wages are down 2.9% from April 2021, and down 3.6% from December 2020:

It is going to take more than the recent 8% decline in gas prices to reverse this negative dynamic. Thus simply must be putting a real crimp in consumer spending, which raises the stakes for Friday’s retail sales report for June.