- by New Deal democrat

Critical self-examination is, or at least ought to be, part of the process of making forecasts. After all, how can you learn if you don’t see how earlier hypotheses panned out? As I have usually done, let’s take a look back at how I forecast 2021 was going to look, to see how well I did.

To make a long story short, according to the long and short leading indicators I track, there was never any real doubt that the economy was going to continue to expand. The only issue was how strong or weak the expansion might be.

Last January, the

short term indicators suggested that the expansion would slow down in the first half of 2021:

“the pandemic is still in control. The LEI has been consistently positive, but at a sharply decelerating rate, for the past 8 months. That suggests a continued but slowing expansion through spring into early summer.”

“There are 6 positives . . . There is 1 mixed indicator . . . [and] There is 1 negative . . . .

“In conclusion, the long leading indicators support a firm, even strong expansion through the remainder of 2021, the pandemic is controlled or resolved via vaccinations and intelligent Federal policy.”

At the same time, the housing market and corporate profits as reported in the Q4 2020 GDP report sounded a caution for later in the year:

“these [housing sales, real residential investment, and proprietor’s income] are a caution flag that, while the economy is likely to boom - or close to it - this year once the pandemic is contained, by year-end that growth may slow considerably

“Put the data points together and, while they are not a warning, they are a yellow cautionary flag that gains in the economy brought about by the 2020 housing boom may abate if not reverse by year-end 2021.”

At midyear, I updated the forecast for the second half of 2021 based on the short term indicators. The conclusion was again straightforward:

“with very few exceptions all of the indicators for the next 6 months of the economy, through and past the end of the year, are very positive, confirming in the short term the message of the long leading indicators in the second half of 2020.”

“My base case for this year has been that with Federal stimulus and accommodating monetary policy, as the economy reopened from the worst levels of the pandemic, there has been an outright Boom. The pandemic - and the response thereto - remains an exogenous dispositive factor. But with 62% of adults fully vaccinated, another 11% partially so, and with final approval of one vaccine likely to lead very quickly to widespread public and private vaccine mandates, I expect its impact to wane considerably once the Delta wave crests and just as quickly recedes.

“And so, true to my "just the facts, ma'am" approach, I am forecasting that the economy will continue to expand broadly over the next 6 months.”

So, as fo the end of 2021, what do the coincident indicators look like for the year?

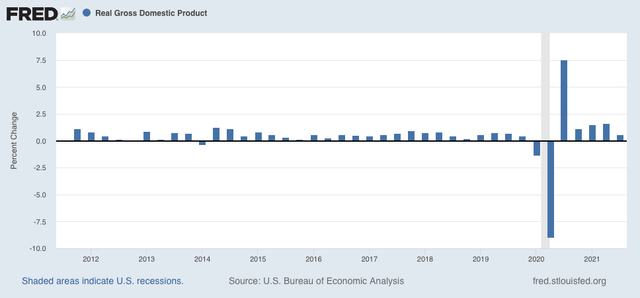

Here is real GDP growth measured quarter over quarter:

The economy did indeed continue to grow, and with the exception of Q3 of 2021 (which at +0.6% annualized was still average for the past 10 years), grew very strongly compared with the entire 10 year expansion that preceded the pandemic.

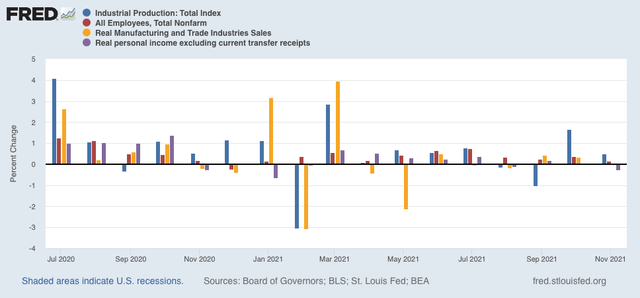

Here are the “big 4” coincident indicators, including industrial production, jobs, real income, and real sales through November:

With the exception of February and November, all of the months were positive, and especially so in spring and summer.

In conclusion, the long and short term leading indicators did their jobs very well in forecasting the expansion, even Boom, of 2021. The one portion where I fell short had to do with the course of the pandemic in the latter part of the year, as the stubborn minority of anti-vaxxers allowed COVID a large reservoir of available new victims to infect, especially as the super-infectious Omicron variant came along at year end.

In the next several weeks, I will post my short and long term forecast for 2022 using the very same methods that were so successful last year.