- by New Deal democrat

March personal income and spending were both reported this morning, completing the set of coincident indicators for the month - and both set records.

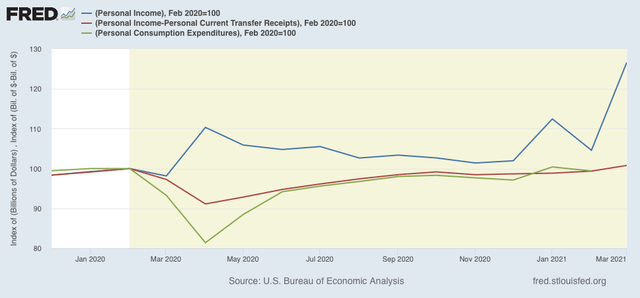

Personal income was up 21.1%, buoyed by another round of stimulus checks. Meanwhile personal spending increased 3.4%. In dating recessions, the NBER takes into account and subtracts transfer receipts (I.e., government payments). For some reason, FRED hasn’t updated personal spending yet, nor added the “real” inflation adjusted data, but here’s what all three look like unadjusted:

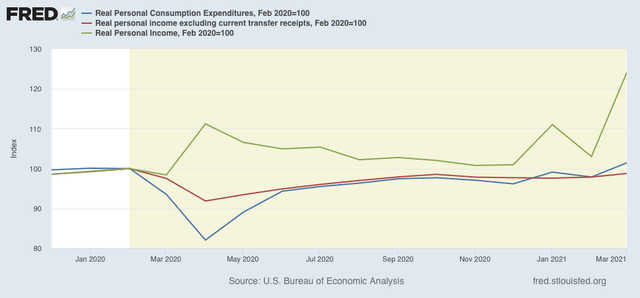

UPDATE: Here are the inflation-adjusted numbers:

We are probably close to the NBER dating the end of the coronavirus recession. I suspect they will wait for all of the Q2 data including industrial production and GDP to be reported in July, as well as being sure that the pandemic does not surge again, before actually making the call. In any event I suspect they will date the end of the recession as either being last April (when the lockdowns ended and the monthly data all bottomed) or last June (if they use Q2 2020 GDP as the decisive metric). Keep in mind that recessions end when the data bottoms, not when it returns to previous highs. The rebound is the period of recovery, and once new highs are set, especially in real GDP, is when recovery transitions to expansion.

All of which causes me to look forward to my next set of worries. Like everyone else, I am expecting at least a brief bout of inflation, partly due to pent-up demand, and partly due to supply bottlenecks. There are signs, especially in commodity prices and in the buyers’ panic in the housing market, that the economy is at least temporarily overheating.

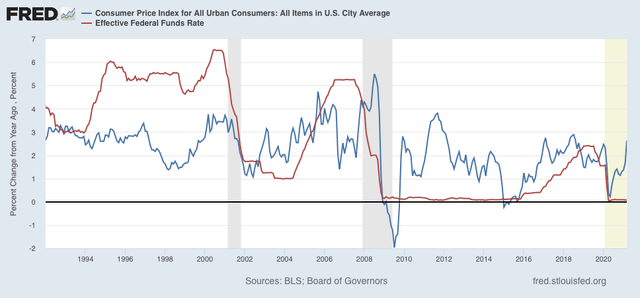

Which means that the Fed might step in and raise rates soon. When? Well, as the graph below shows, in the past 30 years they have stepped in whenever consumer inflation exceeded 3% YoY:

Even if the Fed intends to be tolerant now, should inflation top 4% even for 2 or 3 months, I suspect they will start to raise rates rather aggressively.

Which adds to my worries about next year. We already have increased interest rates, signs that housing sales and construction (via new permits) - *NOT prices! - have peaked, and possibly that corporate profits are being squeezed. A tightening yield curve would add to concerns that a recession, or at least a sharp slowdown, will be arriving just in time for the 2022 elections.