- by New Deal democrat

Weekly initial and continuing jobless claims give us the most up-to-date snapshot of the continuing economic impacts of the coronavirus on employment. Three full months after the initial shock, the overall damage remains huge, with recalls to work roughly balanced with spreading new secondary impacts.

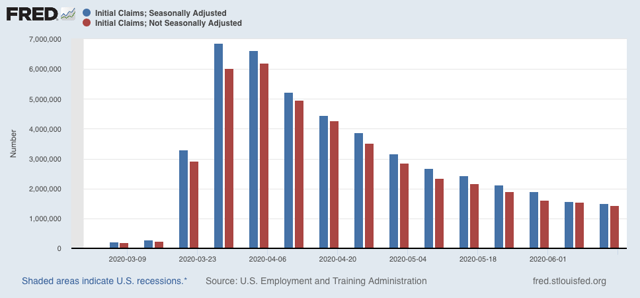

First, here are initial jobless claims both seasonally adjusted (blue) and non- seasonally adjusted (red). The non-seasonally adjusted number is of added importance since seasonal adjustments should not have more than a trivial effect on the huge real numbers:

There were 1.433 million new claims, which after the seasonal adjustment became 1.508 million. This is “only” 58,000 less than last week’s number - the smallest weekly decline since the worst reading in April, but nevertheless is the lowest so far since the virus struck.

These new claims show objectively huge second-order impacts continuing to spread.

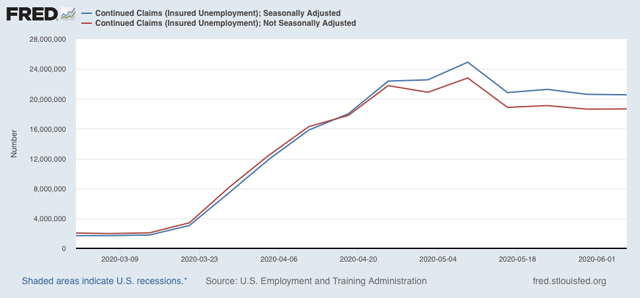

The “less bad” trend has leveled off in continuing claims, which lag one week behind. In the past four weeks, both the non-seasonally adjusted number (red), and the less important seasonally adjusted number (blue) have remained nearly stationary. This week the former declined by only 62,000 to 20.544 million, 4.368 below its peak of 24.912 million four weeks ago; while the latter actually rose slightly by 26,000 to 18.654 million, but still 4.140 million below its peak of 22.794 million reading four weeks ago:

These new claims show objectively huge second-order impacts continuing to spread.

The “less bad” trend has leveled off in continuing claims, which lag one week behind. In the past four weeks, both the non-seasonally adjusted number (red), and the less important seasonally adjusted number (blue) have remained nearly stationary. This week the former declined by only 62,000 to 20.544 million, 4.368 below its peak of 24.912 million four weeks ago; while the latter actually rose slightly by 26,000 to 18.654 million, but still 4.140 million below its peak of 22.794 million reading four weeks ago:

In other words, the spreading new damage shown by the continued huge numbers of new jobless claims is about equal to the callbacks to work from various sectors “reopening.”

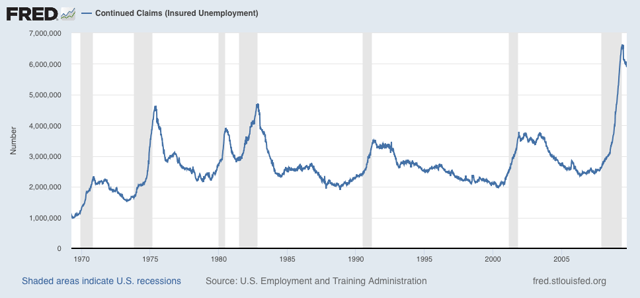

On a more long-term note, historically continuing claims have peaked at the end of or just after the end of recessions. Here’s the graph showing that from the beginning of the series through 2009:

Since this week the “King of Coincident Indicators,” industrial production was reported to have risen in May, and real retail sales also rebounded strongly, the decline in continuing claims over the past month is consistent with a determination by the NBER that a very short recession has already ended.

Because there is increasing evidence of renewed exponential spread by the coronavirus in States that recklessly reopened, all of the improving economic data (improving from absolutely horrible levels of course) may come to an abrupt end in the next few weeks.