- by New Deal democrat

This morning we got some monthly economic data that will be actually valuable to watch throughout this Coronavirus Recession: consumer prices. That’s because during recessions, consumer price growth decelerates, as does wage growth, which continues to decelerate well after the recession bottoms out.

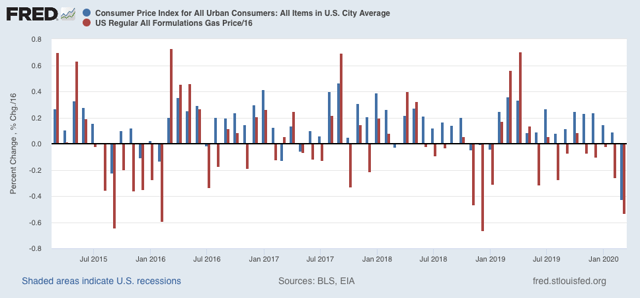

Since monthly changes in inflation are closely correlated with the gas prices, let’s start by comparing the two:

Gas prices declined -8.5% during March. Unsurprisingly, consumer prices followed suit, declining by -0.4%.

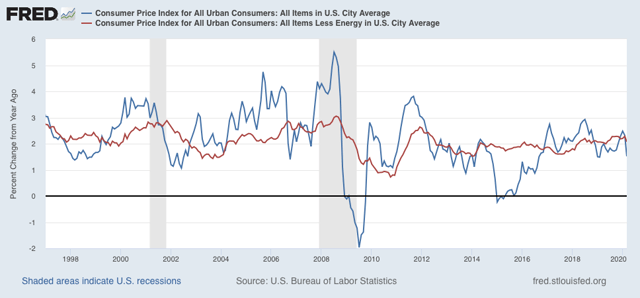

Next, let’s compare overall consumer inflation (blue again) with consumer inflation ex-energy (red), since prior to the past two recessions the latter had increased by 2.5% or more YoY:

We were on the cusp of that 2.5% threshold just before this recession hit. Note that inflation ex-energy tends to follow overall inflation with a slight lag. If gas prices remain depressed, we can expect this “core” inflation measure to decelerate substantially as well. This is par for the course during a recession.

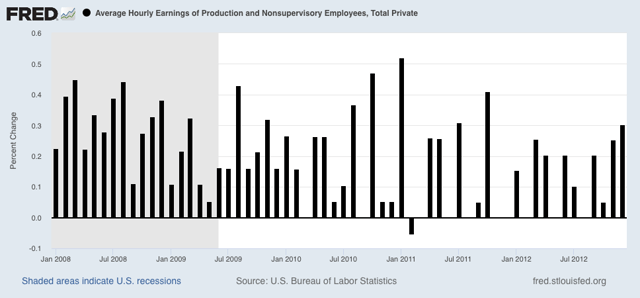

What is much more worrisome to me is whether wage growth, which came close to completely stalling even nominally during and after the Great Recession, with 16 months of wage growth of less than +0.1%, as shown below, might actually tip into deflation this time around - a concern that I have repeated numerous times during the past expansion:

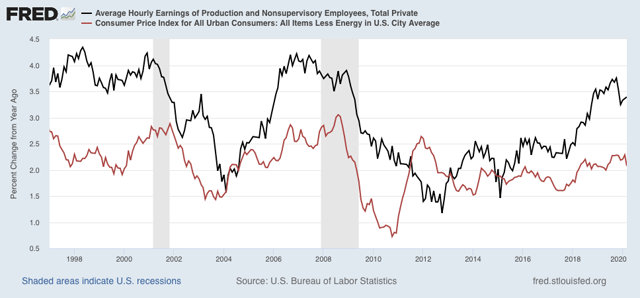

Here is what YoY wage growth (black) looks like in comparison with consumer prices ex-energy (red):

Expect wage growth to decelerate sharply almost immediately. Should it ever tip into negative territory, that would open the door almost instantaneously to a vicious wage-price deflationary spiral, the type of which was last seen during 1929-32. Keep your fingers very crossed.