- by New Deal democrat

Four years ago, I decided to use my set of “long leading indicators” to forecast the 2016 election. The indicators were very weakly positive, and pointed to a narrow popular vote win for the incumbent party one year out. This prompted Nate Silver to huff and puff that nobody knew anything about what the economy would look like so far off. One year later, the economy was very weak, the downward move in the unemployment rate had stalled, and the incumbent won the popular vote narrowly (but obviously not the Electoral College vote).

Well, the 2020 election is 11 months away. So it’s time to do the impossible again.

As I wrote four years ago, going back 160 years, roughly 3/4 of all US Presidential election results have correlated positively with whether or not at the time of the election campaign, the US was in a recession or not. More than 2/3 of the time, it accurately predicted the Electoral College winner, and 80% of the time, it accurately showed the winner of the populat vote. In fact, if we simply go by the metric of whether or not the US was in recession during the 3rd Quarter of the election year, then 84% of the time the winner of the popular vote was from the incumbent party if the economy was expanding, and from the opposition party if the economy was in recession. (The list of all of the elections, the economic status, and the victor in each election, is available at the link above).

In only 3 of the 11 cases where there has been a recession in the 3rd or 4th Quarter of the election year has the incumbent party been successful maintaining control of the White House. Contrarily, of the 29 times the economy has been expanding during the 3rd and 4th Quarter of an election year, the incumbent party has retained control of the White House nearly 3/4 of the time. If we go by popular vote rather than electoral college result, that average increases to over 80% (Both the 2000 and 2016 elections fall into this category, where there was no recession, the incumbent party won the popular vote, but the electoral college resulted in the opposition candidate being declared the winner).

So, with the election one year off, let’s take a look at “Will there be a recession on Election Day? The simple answer is, left to its own devices, almost certainly not.

Several months ago, analyzing the long leading indicators, I wrote that economic conditions would start to improve by about midyear 2020. Although there has been some deterioration in several long leading metrics since then, that result has remained the same. Below I go through all of the same indicators (7 in all) and their status now. Remember that they suggest how the economy will be 12+ months out.

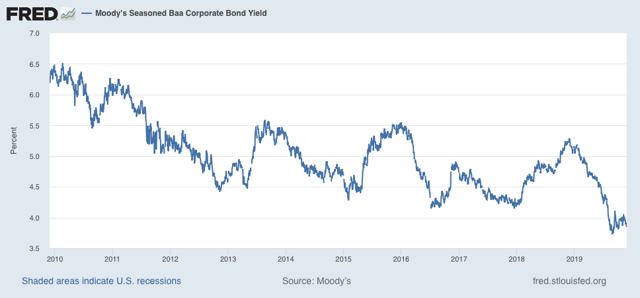

1. Corporate bond yields fell to new expansion lows a few months ago:

This is a positive.

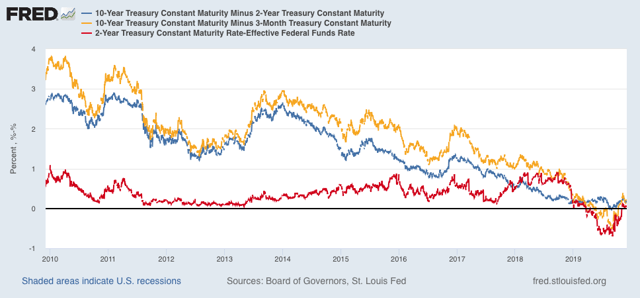

2. The yield curve has in-inverted. When a recession has begun after an un-inversion, it has been within the next eight months (for our purposes, by the end of Q2 next year). Further, the Two year minus Fed funds metric never inverted enough to be consistent with a recession:

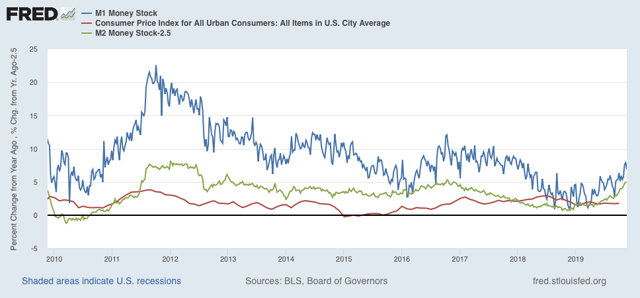

3. Real money supply has turned back to very positive:

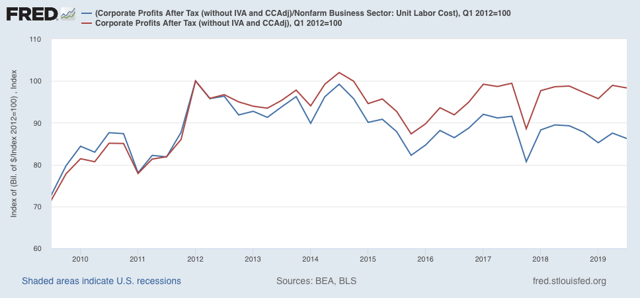

4. Corporate profits adjusted by unit labor costs give a mixed result. Both are lower then their peak, from way back in 2012. But only one version has declined enough to be consistent with an oncoming recession:

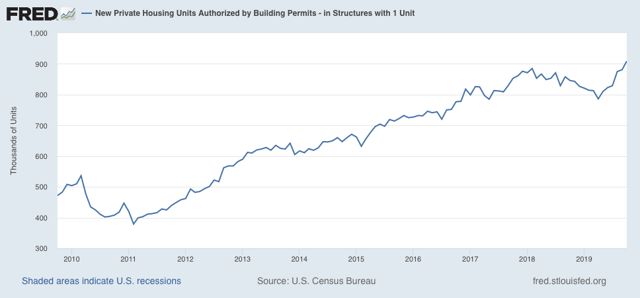

5. Housing permits have rebounded sharply in recent months:

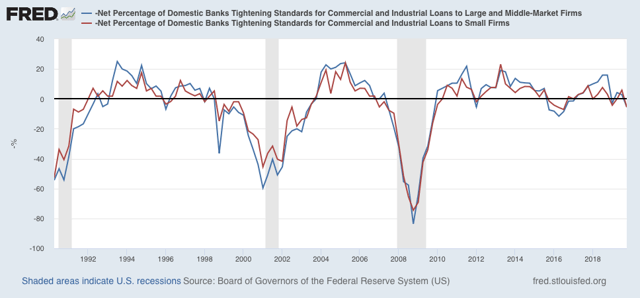

6. Credit conditions are mixed. The Senior Loan Officer Survey has turned negative, although not by much:

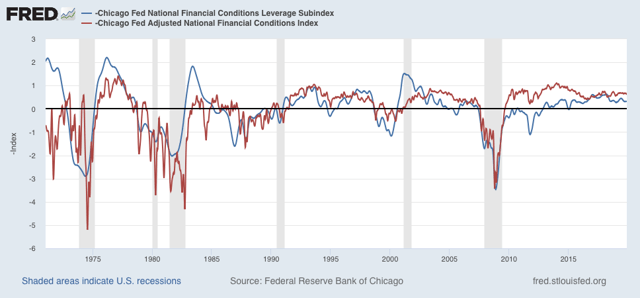

While the Chicago Adjusted National Financial Conditions Index remains positive:

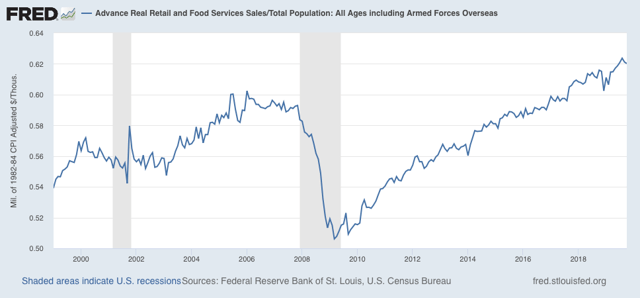

7. Real retail sales per capita have been flat for a couple of months, but recently increased sharply and peaked in August:

To summarize, three of the seven indicators are unequivocally positive: corporate bond yields, housing permits, and real money supply; three are mixed: the yield curve, credit conditions, and corporate profits (with the period of overlap among the negative iterations being limited to the 3rd Quarter); and one is negative, but only slightly compared with its recent 3rd Quarter peak: real retail sales per capita.

So, while it is possible that a recession could be upon us in the 3rd or 4th Quarter of next year, if the economy is left to its own devices it is unlikely. (although Tarriff Man will do his best to undermine this).

So, while it is possible that a recession could be upon us in the 3rd or 4th Quarter of next year, if the economy is left to its own devices it is unlikely. (although Tarriff Man will do his best to undermine this).

Obviously, this is an argument for an incumbent party popular vote victory. But there have been 10 cases where the economy has been in expansion and the incumbent party’s nominee still lost. One was the “jobless recovery” of 1992. Almost all the others have involved war (1952, 1968), civil discord or scandal (1968 again, 1976, 2000), or a disliked incumbent party candidate and/or a party split (1912, 1992, 2016).

In short, the overall economic picture is a baseline. Non-economic factors having to do with the President’s personality or record do come into play as well (as will be explored by several other models). And it’s already quite clear that 2020 is going to include both civil discord and scandal.