- by New Deal democrat

The wage-earner/consumer remains in decent shape, and a lack of inflation (continued low gas prices!) continues to be able to hide a multitude of sins. That’s the message from this morning’s June report for personal income and spending.

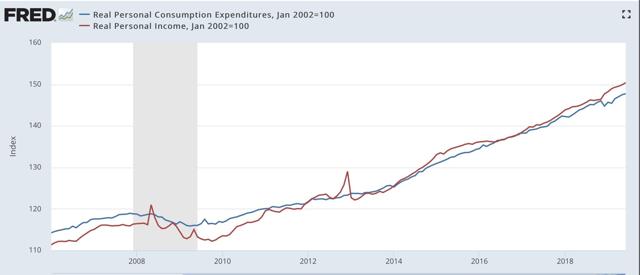

Nominally, income rose +0.4%, while spending rose +0.3%. Since inflation as measured by the PCE price index only increased 0.1%, that means both real income and real spending rose +0.3 and +0.2%, respectively:

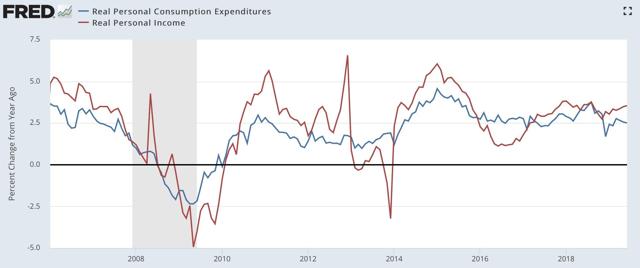

Here’s the same data YoY:

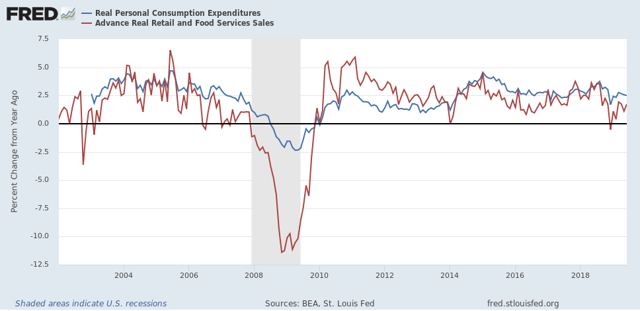

As I’ve written about many times over the past ten years, earlier in the cycle retail sales tend to grow more than the broader measure of personal spending; later in the cycle retail sales decelerate first. Here’s what that looks like updated through June:

This continues to look like a later-cycle consumer who is in pretty decent shape for the moment. And probably will be until either inflation picks up, or international trade weakness bleeds into a broad producer-led slowdown.

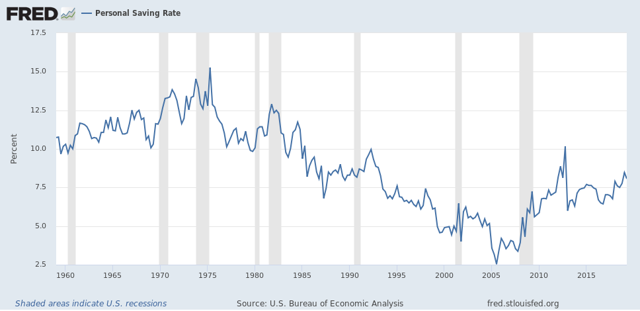

One final note. Something interesting is happening with the savings rate (i.e., the percentage of their income that people don’t spend) — it has been gradually rising, by a total of 2%, over the past several years. Why is that interesting? Because, here is the long term picture:

An increase in personal saving over the course of an economic expansion is something that hasn’t happened in almost 50 years! I’m not sure what exact dynamic is in play, so I won’t commment further. But it is very interesting, and I’m mulling it over.