- by New Deal democrat

Yesterday featured the week’s sole important economic release: new home sales. But first, let’s update the inverted bond yield curve, which got more dramatic yesterday. The below graph compares the depth of the inversion yesterday (bottom) with March of 2007 (top):

With the sole exception of the 2 vs. 10 year spread, the yield curve is virtually screaming oncoming recession at this point.

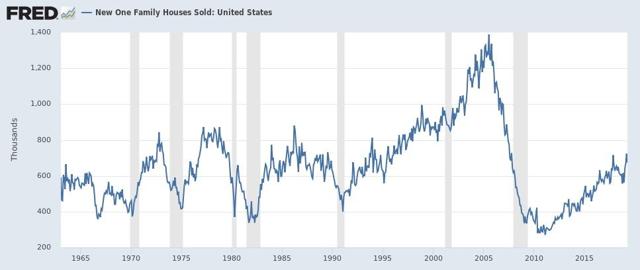

Now let’s turn to new home sales. As a refresher, new home sales are the most leading of any housing series, but they are extremely volatile and heavily revised. Yesterday they were reported down -6.9% m/m for April, but that wasn’t the important news, because March was revised higher to a new expansion high. As the below graph shows, only once in the past 50+ years have new home sales made their cycle low *before* the onset of recession - in 2000:

So, while it’s only one data series, just going by past history, yesterday’s report very likely negatives any recession in the near future, completely contradicting the bond yield curve.

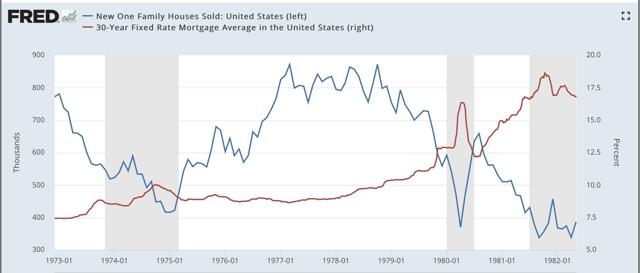

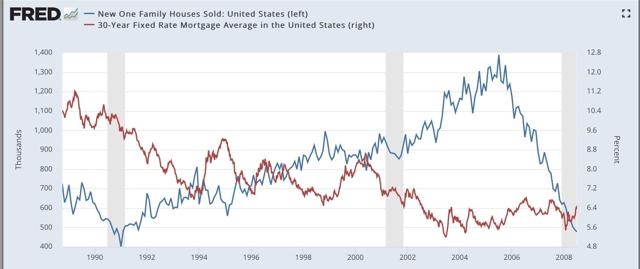

Of course, mortgage applications, and new home sales, have rebounded this year because interest rates have fallen from a peak of close to 5% last November to 4.1% this week. So in the below two graphs, I show new home sales (blue) vs. mortgage rates (red, right scale) since the latter series was started in 1971:

Mortgage rates didn’t decline at all prior to the 1980 recession, and declined only trivially in the month before the onset of the 1970 and 1981 recessions. They declined more significantly — -0.6%, -1.7%, and -0.8% — before the onset of the 1991, 2001, and 2008 recessions. In the cases of both the 1991 and 2008 recessions, housing still declined in part due to oil price shocks and in 2008 the unwinding of leverage in housing and the mortgage markets. The 2001 recession, by contrast, was a producer-led downturn, as the dotcom bubble imploded, so the mild upturn in housing was not enough to overcome it. Housing did turn down *during* the 2001 recession, as people got laid off, but did not match its 2000 low.

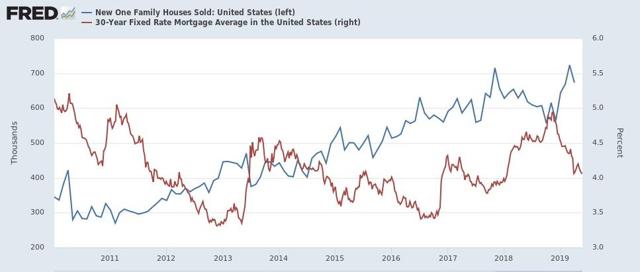

Now here is an update of the same data for this expansion:

The bounce in new home sales in the past several months has been much stronger than that of 2000.

The big fundamental question in the economy right now is whether the upturn in housing will be enough to overcome the downturn in corporate profits for the past two quarters. In short, one of these two powerful economic indicators is giving a false signal.