- by New Deal democrat

This morning’s retail sales report for February was disappointing on a monthly basis, but also signals caution for the economy as a whole.

On a nominal basis, retail sales declined -0.2% for the month, although January was revised higher, to +0.7%.

On an inflation adjusted basis, the news was worse, as the monthly decline was -0.4%.

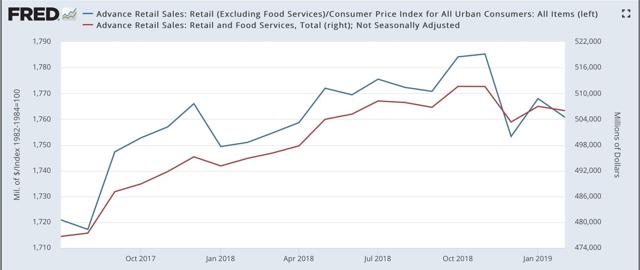

Below are real retails sales for the last few years, and because it is a long leading indicator, real retail sales per capita (in red):

Both of these last made new highs in November. Because there is a lot of noise in the data, it is almost impossible to know whether or not this is true signal.

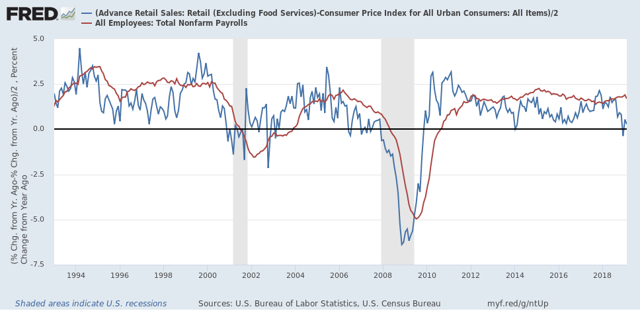

Although the relationship is noisy, because real retail sales measured YoY tend to lead employment (red in the graph below) by a number of months, here is that relationship for the past 25 years:

This is yet another sign that employment gains are likely to downshift significantly over the next several months.

Next, here are both forms of real retail sales YoY recently:

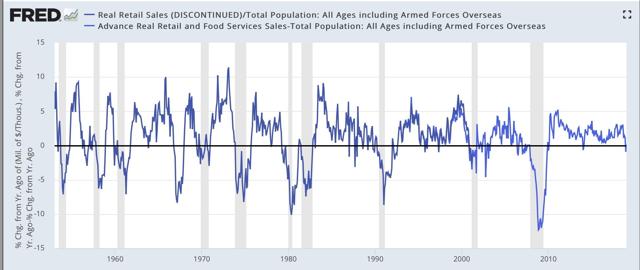

And here are real retail sales per capita YoY, going all the way back to 1948:

In the last 70 years, this measure has always turned negative at least shortly before a recession has begun. There are no false negatives. While there are about a dozen false positives for a single negative month, there are only four false positives for consecutive negative readings — 1966, 1995, 2002, and early 2006.

Real retail sales per capita YoY just escaped making its second negative reading in three months. So while sales are definitely sounding a note of caution - call it a yellow flag - they aren’t flashing red at this point.