- by New Deal democrat.

Now that we have February’s CPI (up +0.2%), let’s update nominal and real wage growth.

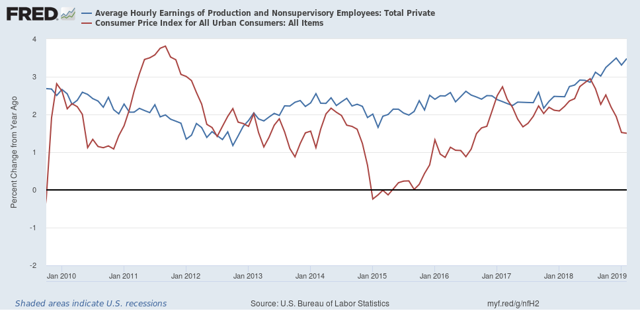

First, here is a graph of nominal wage growth YoY vs. consumer inflation YoY since the beginning of this expansion almost 10 years ago:

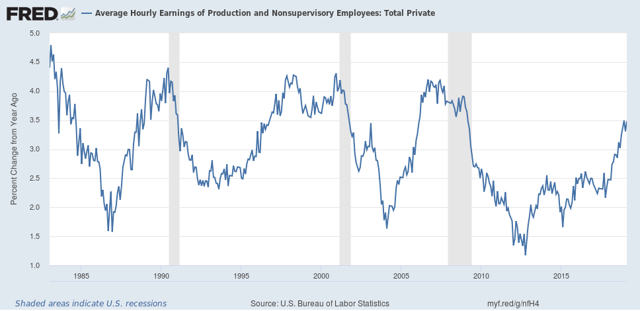

First of all, why do I bother with nominal wages? Because employers don’t give out inflation-adjusted salary and wage increases. If they give you a 3% raise, it’s a 3% raise regardless of what happens to inflation. And the long term picture is that nominal wage growth decelerates coming out of recessions until unemployment (or, more likely, underemployment) falls to the point where employees gain a little bargaining power:

To return to the first graph, nominal wage growth has been improving YoY since late 2012. Meanwhile CPI has been meandering around a 2% YoY average, depending on what has been happening with gas prices. Since lately these have been stagnant or down YoY, consumer inflation has waned.

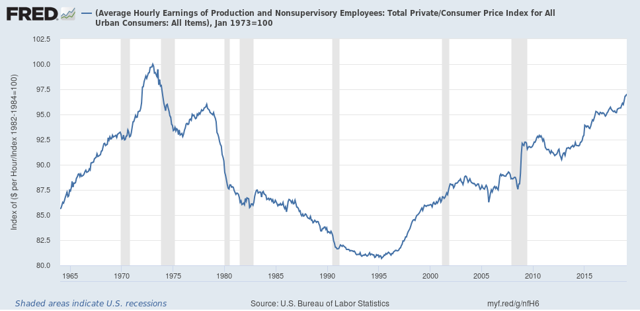

As a result, real wages have improved considerably in the past year, to the point where they are now exactly -3% off their peak in the early 1970’s:

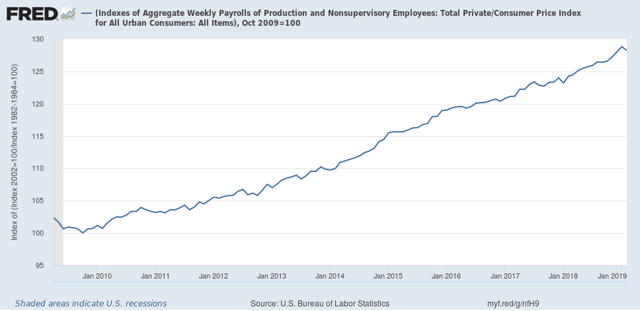

But because aggregate payrolls declined in February, according to the employment report, the aggregate pay that non-managerial workers took home, in real terms, declined by -0.4% in February. In real terms, this amount has increased by 28.2%, down from an increase of 28.6%, more than they earned at the worst point after the Great Recession in October 2009:

Neverthelss, real wage growth in general continued to be good news. Be aware, however, that real wage growth is a long *lagging* indicator, that starts up well after a recession bottoms, and can continue even into the next recession.