This article is not a solicitation to buy or sell these securities. You might also want to do your own research into this; heck, you just might learn something.

Recently, Morningstar wrote a story titled, "The Ultimate Stock Pickers Top 10 Dividend Stocks" which contained a total list of 20 stocks whose dividend was higher than the S&P 500 and whose shares were owned either by a leading manager or leading fund. Topping one of the lists was Phillip Morris (PM).

Let's start by taking a look at the weekly chart:

The chart is certainly not one to get excited about. It's been trading in a fairly tight range of 75-89, with a tighter range of 79-89 over the last three years. However, the stock price has recently dropped to the 78 level, making it attractive. So, let's take a deeper look at the company.

According to their latest 10-K, Phillip Morris and "[o]ur subsidiaries and affiliates and their licensees are engaged in the manufacture and sale of cigarettes, other tobacco products and other nicotine-containing products in markets outside of the United States of America. Our products are sold in more than 180 markets and, in many of these markets, they hold the number one or number two market share position. We have a wide range of premium, mid-price and low-price brands. Our portfolio comprises both international and local brands." Their market cap is about 120.5 billion, making them the largest cigarette company according to the Finviz.com website. They are one of the top three cigarette makers, with British American Tobacco and Altria group close second and third runners-up.

Their operations are entirely international, with the following regional breakdown (click for larger image):

In the last three years, the Eastern Europe segment has gained 7.9% of the companies overall sales while the Asian market has decreased 10.3%. Consider this situation in relation to the high level of the dollar, and the negative impact that will have on earnings. Many multi-national companies have stated that the strong dollar is seriously impacting their financial performance; don't expect anything different from PM.

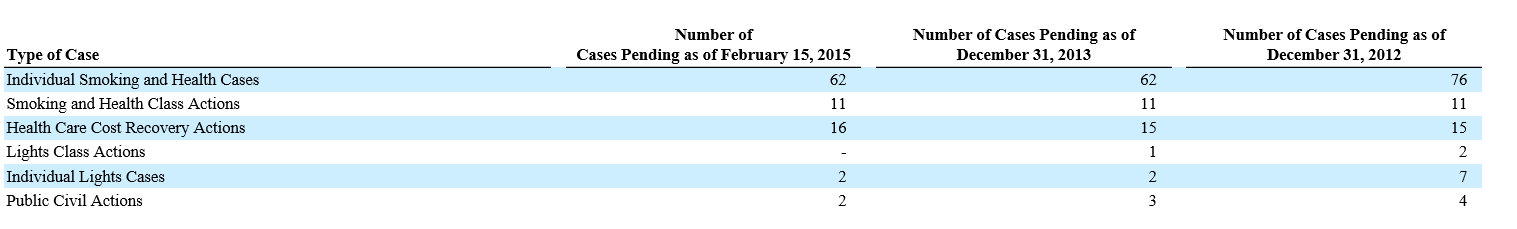

The biggest risk the company faces is litigation and the potential downside of a massive award against the company. As this table shows, the company currently faces 93 different lawsuits (click for a larger image):

But, the company has been very successful at defending these causes of action. From the 10-K: "Since 1995, when the first tobacco-related litigation was filed against a PMI entity, 433 Smoking and Health, Lights, Health Care Cost Recovery, and Public Civil Actions in which we and/or one of our subsidiaries and/or indemnitees were a defendant have been terminated in our favor. Ten cases have had decisions in favor of plaintiffs. Nine of these cases have subsequently reached final resolution in our favor and one remains on appeal."

While this is no guarantee that future litigation will lead to the same result, it does indicate that Morris' litigation team has been strikingly effective.

PM is a leading brand with very high barriers to entry.

Financials

The chart above indicates this is a pure dividend play. While there is upside potential on the current chart, the fairly predictable trading range of the security over the last three years indicates that once the stock hits the mid-80s, bears will take over. This means the most important consideration for any investor is dividend safety. Obviously, the insure a continual payment of the dividend we need, at minimum, revenue and margin predictability.

For the last 5 years, revenue has risen a bit going from $27.2 billion in 2010 to $29.7 billion in 2014. Revenue was higher between 2011-2013, coming in a bit over $31 billion. Expenses have been very predictable over the same period:

COGS: 33%-35%

Operating expenses: 23%-25.6%

Net Income: 25%-28%

The above numbers indicate that revenue and expenses have been very predictable and should continue to be so over at least the next year.

The dividend payout ratio has fluctuated between 55.7% in 2011 to 80.5% in 2014, meaning the company pays out a large percentage of its net income to shareholders.

Just as importantly, PM is a company that prints money, with free cash flow to the firm of between $6.5 billion in 2014 to $9.6 billion in 2011. Their primary operating expense is property investment, which is very predictable, with the figure right around $1.1 billion over the last three years. This is only 14% of the lowest number for operating cash flow for the last five years, meaning the company is flush with cash.

The only drawback to the balance sheet is the company has loaded up on debt, with their long-term debt totals increasing from $13.3 billion in 2010 to $26.9 in 2014. This makes their long-term debt position a whopping 76% of total assets. But, their interest coverage ratio at these high levels is 10.86. And with EBITDA reported at between $12.1 and $14.7 over the last five years (not to mention the company's very strong cash flow position), a default isn't on the horizon.

Conclusion

In a record low interest rate environment, high paying dividend stocks become exceedingly attractive, so long as there is a consistency to the underlying company's financial performance. PM has such a profile, with steady earnings and expenses, a more than adequate cash flow and a strong policy of passing earnings onto shareholders. These factors make PM a solid stock for dividend investors, especially at these levels.