- by New Deal democrat

In March, with the exception of the usual problem child of shelter, almost every other component of consumer prices was tame - except for meat and eggs. And even shelter continued to decelerate. If Jerome Powell hadn’t tied his wagon to the core CPI number that includes shelter, he could simply declare victory over inflation.

Let’s get to the almost all good graphs.

First, here are the headline (blue), core (red), and ex-shelter (gold) m/m numbers m/m for the past two years:

Only last May and June were comparably low.

And here they are YoY:

Headline prices *declined* -0.1% for the month, the lowest reading since the Covid lockdowns of 2020. Core inflation was 0.1%, the lowest since January 2021, and CPI less shelter also declined, by -0.2%, the lowest since March 2023. On a YoY basis, headline prices were up 2.4%, the lowest since February 2021. Core prices were up 2.8%, the lowest since November 2021, and CPI less shelter was up 1.5%, the lowest since last October.

Last month I noted that the February readings in shelter have typically been among the highest of the year, suggesting unresolved seasonality issues, and that certainly appeared to be the correct understanding, given this month’s retreat (m/m is light blue, right scale; YoY is dark blue):

On a monthly basis, shelter increased 0.3%, tied for the 2nd lowest monthly increase in the past 2.5 years. And on a YoY basis, at +4.2%, it was the lowest in over 3 years.

Breaking shelter down further, rent increased 0.3% for the month, and owner’s equivalent rent increased 0.4%. Nevertheless rent was among the lowest monthly increases in the past 3.5 years, and although owners equivalent rent did jump, it was lower on a monthly basis than at any point between the beginning of 2022 and May of last year. When we look at the YoY % change, you can see that the downtrend is intact:

Both measures are at 3 year lows, at 4.4% and 4.0% respectively. Given the recent monthly readings for house prices, I continue to expect slow disinflation winding up somewhere around the 3.5% range within the next 12 months.

The big positive surprise was in even more lagging problem child, transportation services (mainly motor vehicle insurance and repairs), which declined -0.7% for the month! This is the lowest monthly reading since September 2021. On a YoY basis, it decelerated sharply to 3.1%, the best reading in 4 years:

This deceleration was driven by a decline in airfares (perhaps all those Canadians and other foreigners who no longer want to visit the US), and also a -0.8% decline in insurance, although that was still higher by 7.5% YoY. Maintenance and repair prices did continued to soar, up 0.8% for the month.

Further, the former problem children of both new and used vehicle prices appear to have nearly completed their normalization process. New car prices were up only 0.1% for the month and unchanged YoY, while used car prices reversed their February increase and declined -0.7% for the month, and are only up 0.6% YoY:

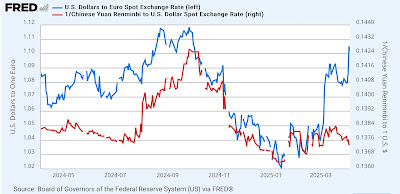

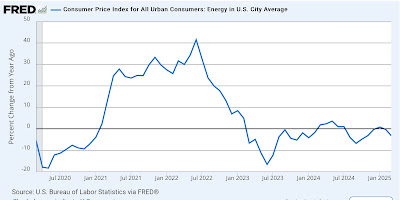

And the icing on the cake was that energy prices declined a sharp -2.4% for the month, and are down -3.2% YoY:

In addition to vehicle insurance and repairs, the only other “problem children” were piped gas utilities, tobacco products — and meat and eggs (m/m light blue, right scale, vs. YoY dark blue):

In addition to egg prices, which are up 60%! YoY, beef and pork prices are also sharply higher.

Bottom line: with the continued exception of shelter, this is the consumer inflation report we have been waiting for, for about the past three years. With the exception of motor vehicle repairs, meat — and eggs — everything broke lower this month. And shelter, as expected, has continued its slow deceleration. This is an economy which *ought to* enjoy smooth sailing in the months ahead on the inflation front — so long as no Idiot King comes along to mess it all up.