- by New Deal democrat

- Empire State https://www.newyorkfed.org/survey/empire/empiresurvey_overview.html down -26.3 to -14.9

- Philly down -14.9 to +8.7

- Richmond up +4 to 0

- Kansas City down -1 to -7

- Dallas down -11.2 to -3.5

- Month-over-month rolling average: down -8 from +5 to -3

The regional average is more volatile than the ISM manufacturing index, but usually correctly forecasts its month-over-month direction. The ISM report for February already showed new orders retreating into contraction, so this suggests a further retreat next month. The three remaining regional Feds will report over the next 10 days.

On Wednesday I also reiterated that production typically responded to changes in sales, rather than anticipating them, pointing out that sales typically turn higher or lower before inventories do.

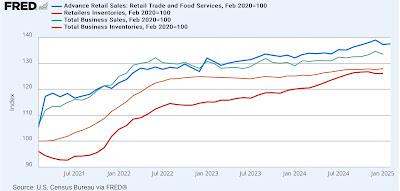

Since we had the report for retail sales earlier this week, here is the update of retail sales (dark blue, thick line) and total business sales (light blue, thin) vs. retail inventories (dark red, thick line) and total inventories (light red, thin) through February:

The leading/lagging relationship is easier to see on a YoY% basis:

In 2022 and 2023, the YoY change in inventories lagged sales by roughly 6 months. The relative bigger incrrease in retail inventories in late 2024 may be an exception to the rule, but is likely just noise, especially since total business inventories did not confirm that big increase.

One thing that has distinguished slowdowns in growth from actual recessions in the past several decades has been how quickly businesses can adjust their inventories to a decline in sales. The “just in time” system allowed for quicker responses. To the extent the current situation is driven by tariff and other policy uncertainties, businesses may not be able to be so nimble.