- by New Deal democrat

With the report on September inflation yesterday, we can update two measures of how well average American workers are doing: real average wages and real aggregate payrolls.

Nominally wages increased 0.2% for the month. With consumer prices up 0.4%, real wages declined -0.2%:

Real wages had been in an increasing trend since gas prices peaked in June 2022. Now that the decelerating trend in headline inflation has ended, that trend has ended as well. The initial peak right after the pandemic is somewhat illusory. It is a side-effect of the fact that during the pandemic lockdowns many more low wage workers (like in restaurants and bars) lost their jobs than white collar office workers. The September 2021 peak is more realistic. Real wages are down -1.5% since then.

Real aggregate payrolls for nonsupervisory workers tell us how much purchasing power the working and middle classes have as a whole. When it falls below inflation on a YoY% basis, it has been an excellent coincident marker for the onset of a recession going back 60 years:

There have been no false positives, and no false negatives.

As you can see, last year the lines got very close (about 1.5% apart) before inflation decelerated faster. Now that the deceleration in headline inflation has ended, even as the deceleration in wage gains has cointinued, the lines have gotten a little closer again, with YoY growth in nominal payrolls just over 2.0% better than inflation.

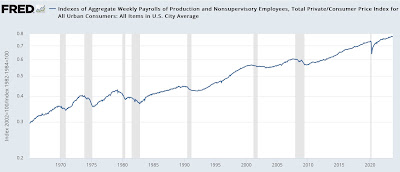

Of course, before YoY real aggregate payrolls turn negative (i.e., lower than inflation) real aggregate payrolls must necessarily peak. Here’s the historical 60 year graph of that:

Again, there is a perfect record, with peaks on average about 6 months before the onset of a recession. But not *every* peak, no matter how minute, leads to recession, which is why the YoY comparison is more meaningful.

Nevertheless, with the deceleration in payroll gains vs. inflation, real aggregate payrolls are down -0.4% from their July peak for the 2nd month in a row:

The longer we go without a new high in real aggregate payrolls, the closer the metric will come to its crossover point.