- by New Deal democrat

I’ve been reading increasing talk about the fabled “soft landing,” or alternatively, “rolling recession.” For example, over the weekend Liz Ann Sonders of Schwab told “Wall Street Week” that housing is already in a recession, but the larger services side of the economy was still in good shape.

Let me start out by noting that the goods side of the economy has almost always rolled over first, as shown in the graph below:

That’s why things like the manufacturing workweek and the ISM manufacturing index are leading indicators, while consumer spending on services is not.

But here’s a bigger issue: despite the huge downturn in housing permits and starts, that important sector isn’t really in recession yet at all! That’s because, due to the supply chain issues in building materials that plagued the industry last year, the number of houses under actual construction hasn’t turned down at all. In fact, last month it was at a new record high:

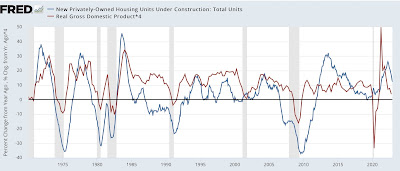

And why do I think that is the #1 reason the economy hasn’t gone into recession yet? Below is a graph of the YoY% change in housing units under construction (blue) vs. the YoY% change (*4 for scale) in real GDP (red):

There has *never* been a time when real GDP turned negative YoY without housing construction having turned negative YoY first. Never.

And as the graph shows, as of December YoY housing units under construction were up 12%.

I fully expect this to turn down sharply, and soon. Of course, it has been something I have expected for a few months already. We’ll find out what happened in January when housing permits, starts, and construction for January are reported on Thursday.