- by New Deal democrat

First, an editorial note: economic news is light this week, so don’t be surprised if I play hooky for a day or two.

That being said, let’s take a look at the most important trends, as I see them, from Friday’s employment report. The Big Question is, are we having a proverbial “soft landing?” Or is that just an illusory phase on the path of deceleration to something worse? Let’s take a look.

Jobs Growth

The 2023 record on job creation is susceptible to both interpretations. Since, alas, one shortcoming of FRED is that it does not have a setting for 3 month moving averages, I am outsourcing this graph to Harvard economist Jason Furman:

If we start from July 2021, there’s a clear pattern of continuous deceleration through this July. But if we start with March on the monthly numbers, or April in the 3 month average, the trend is sideways. It could just be a pause in the longer term trend, or it could be an inflection point. Since nonfarm payrolls themselves are a coincident indicator, we want to look at more leading indicators to see if a more likely answer becomes clearer.

The Leading Metrics in the Report

With a few exceptions, the leading jobs sectors have not turned down yet. Here’s the group of such leading sectors I highlight for each jobs report, plus truck transportation, all normed to their highs at 100:

With the exception of temporary help services, which peaked early last year, and truck transportation, which peaked this past January, all the other sectors are either at their highs or within 0.1% of them.

Separately let’s also look at the manufacturing workweek, one of the 10 “official” leading indicators. I’ve subtracted 40 from the actual number, because before 1983, usually hours had to fall below that measure of full-time work in order to signal recession:

While the workweek has declined by almost 1 hour since its peak, notice that it has stabilized since last December at between 40.6 and 40.9 hours, and is currently at 40.7.

I would expect all of the above metrics to decline, or decline further, before any recession begins. At the moment they are consistent with both the “soft landing” and the “continued slow deceleration” scenarios.

The short and long term Unemployment rate

The unemployment rate is somewhat unique, in that it leads going into recessions and lags coming out. And as I point out each week, it follows initial jobless claims with a lag of several months. Here’s the update of that with Friday’s 3.9% rate included:

This is weak, but it does *not* trigger the Sahm rule, which requires a 0.5% increase from the lowest 3 month averag of the past year. Also remember it is reflecting the very elevated initial jobless claims of several months ago. As initial claims have come back down, I expect some relief in coming months as to the unemployment rate as well.

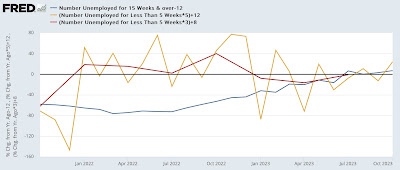

One “dark” point in Friday’s report was that long term unemployment has increased sufficiently so that in every prior case going back half a century, there was a recession (see TBPInvictus, who way back in the day used to post here, and Cullen Roche, both on the Bird Site]. I want to delve into this separately in another post, but for now I just want to point out that the trend in longer-term unemployment much more often than not follows that of shorter term unemployment. Unemployment for less than 5 weeks was one of the leading indicators highlighted by the late Prof. Geoffrey Moore as one of his leading indicators, and it is part of my regular monthly report as well.

Here is the historical comparison of both short and longer term unemployment historically [I have normed the series so that their current readings = 0; also because short term unemployment (gold) is much more volatile than longer term unemployment (blue), I also include the quarterly average of short term unemployment, which distills signal from noise (red)]:

Once we distill signal from noise, over the long term, shorter term unemployment has almost always waxed and waned before longer term unemployment. Usually but not always they also turn up first before a recession begins as well.

While longer term unemployment is indeed currently consistent with a recession, short term unemployment is not:

Unless and until both initial jobless claims and short term unemployment confirm the message of longer term unemployment, I am not treating it as anything beyond a caution signal.

Aggregate real payrolls

Finally, as you probably recall, I consider aggregate real payrolls for non-supervisory employees an excellent coincident indicator of recession, when the YoY change in payrolls is less than the YoY change in inflation. Here’s what that currently looks like:

It is likely when we get this month’s inflation report next week that the gap will narrow further, but will remain positive.

This indicator has been saying “soft landing” since the end of last year, but if as I suspect wages keep decelerating while headline inflation stabilizes, it will be more consistent with the “continuing slow deceleration” scenario.

In conclusion, the jobs report for October is convincing that there is no recession now. But it is not convincing for either the “soft landing” or “continued slow deceleration” scenario. If we are truly going to have a “soft landing,” I would expect to see continuing jobs growth of 100,000 or more each month, an unemployment rate below 4.0%, and no downturns in either construction jobs or goods producing jobs as a whole.

I’ll be paying heightene attention to those markers going forward.