- by New Deal democrat

My final update this morning is for industrial production, the King of Coincident Indicators, which has most frequently corresponded with peaks and troughs in economic activity as determined by the NBER.

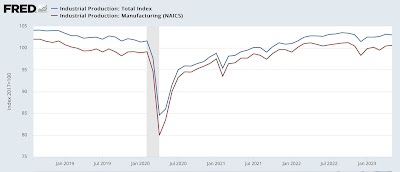

The news for total production was not good, as it declined -0.2% in May, and March and April were revised -0.2% lower each. It remains -0.5% below its recent peak last September. Manufacturing production did increase 0.1%, and March and April were revised higher, but it also remains -0.6% below its recent peak last October:

YoY production is up 0.2%, and manufacturing production is down -0.3%. In the 80 last years of the 20th century, total production had only been this low YoY several times in the 1950s and also in 1984 without there being a recession. Manufacturing production had a similar record once it was separately recorded in 1964. But since the “China shock“ that started at the turn of the Millennium, however, there have been 3 separate downturns that were as bad or worse, without there being a recession:

To sum up the three data series I have reported on this morning, *all three* are at or close to levels which for most of their past history have been consistent with recessions. As I’ve noted several times recently, the economy is being buoyed by real personal spending or services, and by job growth that is still trying to catch up with that increased spending ignited originally by the pandemic stimulus.

Later this morning total business sales for April will be reported. I’ll take a look at those, and estimate what they mean for another important coincident indicator, tomorrow.