- by New Deal democrat

Today is one of those data-palooza days, so I’ll put up separate posts on personal income and spending, and the ISM manufacturing report and construction spending reports later.

But let’s start with weekly jobless claims, and the news here is OK for the week, but the trend is troublesome.

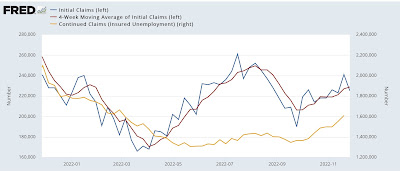

Initial claims declined -16,000 from last week’s 3 month high to 225,000. But the 4 week average climbed 1,750 to 228,750, the highest level since January 22 of this year. Continuing claims rose 57,000 to 1.608 million, the highest since February 26:

In the absolute sense, very few people are getting laid off, and those who are still are able to find new jobs pretty quickly. But the trend is deteriorating. At its recent pace, the 4 week average of initial claims is likely to go negative YoY by the end of this month.

In the past, if the 4 week average is more than 5% higher YoY for any significant period of time, and less reliably, if the slightly lagging continuing claims are higher YoY, a recession is almost always close at hand:

The first marker could be met by January 1. The second marker could be met by February.

Since initial claims is one of the last positive short leading indicators, this is a bad sign.