- by New Deal democrat

Later this morning existing home sales will be reported for October, which will mainly be of interest to me only for what happened with prices, and secondarily whether the problem of low inventory which has existed for 3 years is moving in the direction of resolution.

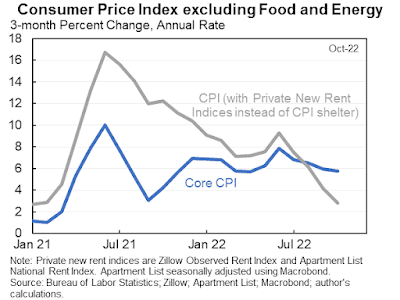

In the meantime, yesterday Jason Furman got some traction, and amplification by Paul Krugman, of the below graph which measures core inflation using new rent indices (e.g., Zillow) rather than owners’ equivalent rent:

The implication is - one embraced by Krugman - that inflation is already not a problem.

I don’t think this is really the case, because we are still using an imputation of hypothetical rents to measure house prices.

I don’t think this is really the case, because we are still using an imputation of hypothetical rents to measure house prices.

I already posted a graph of what core inflation ex-shelter would look like:

But let’s go one step further and measure what core inflation, *including* shelter looks like, using actual house prices as measured by the FHFA Index rather than owners equivalent rent, thus banishing the entire problem. Here it is:

Most importantly, as of August (the last month for which the house price index has been reported), YoY core inflation including house prices was 8.6%. At its peak 6 months earlier in February, it was 12.4%. If it were to continue to decline at that rate, in October core inflation using actual house prices would be 7.3% - declining fast, but still above the official 6.3% reading of core inflation using imputed rents. It would take until about next April for core inflation using house prices to get to the Fed’s comfort zone of 3% or less.