- by New Deal democrat

Late last year I introduced the idea that the jobs market was similar to a game of musical chairs, where employers added or took away chairs, and employees tried to best allocate themselves among the chairs.

Because of the pandemic, there have been several million fewer players trying to sit in those chairs, leaving many empty. Additionally, there has been roughly 10% higher demand for goods and services in total in the past year than there was before the 2021 stimulus payments.

As a result, wages have continued to increase sharply, as employers attempt to attract potential employees to sit in the continuing big number of empty chairs.

More importantly for today’s purposes, I further posited that the game of musical chairs will only slow down once some employers throw in the towel, and the number of job openings signficantly declines.

And that, in short, is what appears to have started to happen in May.

[Note: FRED has not updated its graphs yet, so I am using the most recent. I’ll update with current ones when they become available.]

[Now updated.]

Job openings in May declined -427,000 to 11.254 million, a 5 month low:

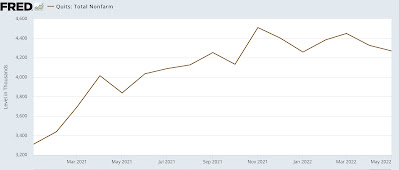

Quits declined -57,000 to a 4 month low:

Hires declined -38,000, but remained near the top of their 12 month range:

On the other hand, layoffs and discharges increased 77,000 to 1.389 million, and appear to be flattening:

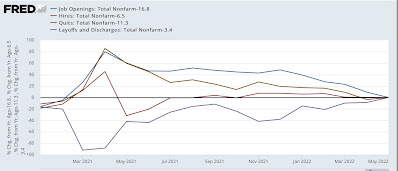

To put the trends in perspective here are the YoY% changes in all of the above metrics since the beginning of 2021, normed to zero at their current levels:

The YoY% change in job openings has slowed sharply to 16.8%, still a very good historical number, as shown in this longer term view of the above graph from 2002-2019:

The increase in quits has also slowed sharply YoY to 11.3%, while layoffs and discharges are up 3.4%, and hires are up 6.5%.

In particular, vs. the 16.8% YoY growth, in the past 6 months openings have only grown 3.0%, and in the past 3 months, have actually declined -0.8%. Openings likely peaked in March.

In other words, a few employers are starting to throw in the towel. Meanwhile, the trend of workers quitting for better-paying jobs is continuing, but also at a slower pace. As a result, I expect nominal wage growth to slow down.

Last month I concluded, “Only when the trend in job openings rolls over, based on a 3 month average, do I expect to see a change in the underlying job market.”

And indeed, this month that average was -0.2% lower. Very slight, and very much within the range of monthly noise, and subject to revision. But it is likely that a significant deceleration in the underlying job market has arrived. We’ll see Friday with the June jobs report.