- by New Deal democrat

The last of the 4 monthly coincident markers for whether the economy is in recession vs. expansion was reported this morning for April. Let’s take a look.

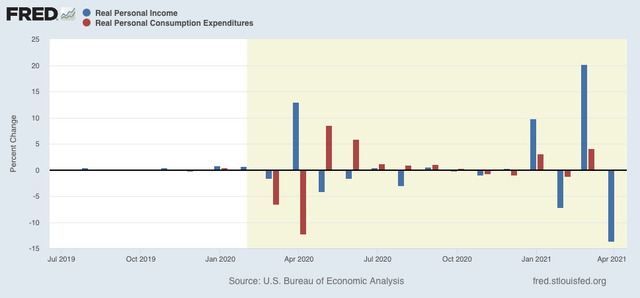

In nominal terms, personal income declined -13.1%, taking back most, not by no means all, of March’s big 20.7% gain. After taking inflation into account, in real terms it declined -13.7%. Meanwhile nominal personal spending increased 0.5%, but in real terms declined -0.1%, barely touching March’s 4.0% gain:

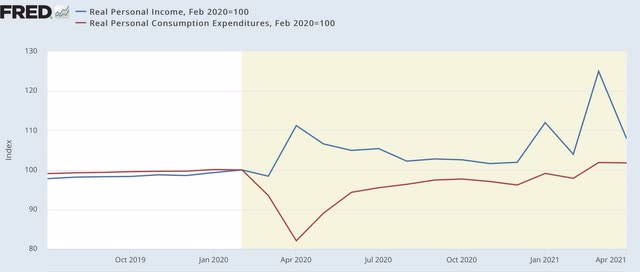

An issue came up at Seeking Alpha about why I believe that demand-driven inflation will be transitory. The above graph shows why. After 2020’s big stimulus package, real personal spending increased sharply and then the effect completely dissipated over a few months. It appears that the same is already happening this year. Which would only leave supply-side temporary bottlenecks in production as sources of continued inflation.

Below I’ve take then same data as above and normed both to 100 as of February 2020:

Both real income and spending are above their pre-recession levels. Simply put, in this crisis decisive action by the government to put cash in consumers’ hands has worked.

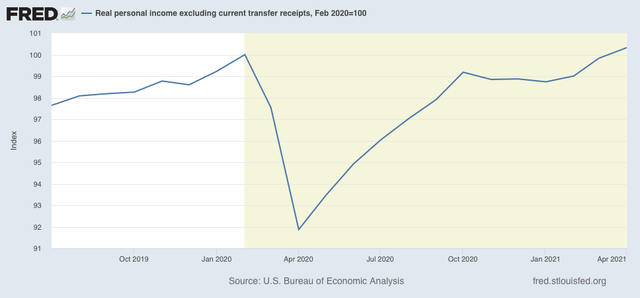

But the “official” recession vs. expansion metric is real personal income less transfer receipts (things like unemployment insurance), shown below:

This too is now above its pre-recession levels. Although I won’t post a graph, this joins real sales making up all of its lost recession ground. But the two most important metrics - industrial production and employment - still have a ways to go.