- by New Deal democrat

There are three potential areas of concern for the economy in the next 12 to 24 months that I see:

1. Inflation - this looks temporary to me. Demand side effects will probably fade by the end of summer, and supply side bottlenecks should fade within the year.

2. Stock price evaluations - I strongly suspect these are near secular highs, and are subject to a serious pullback in the next several years.

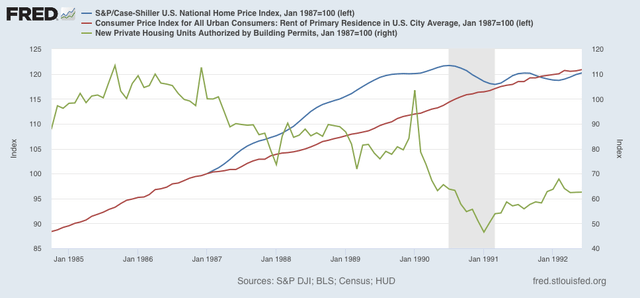

3. Housing - The biggest reason I don’t see this as being in a bubble is the lack of “fog-the-mirror” mortgages being originated. Take away reckless lending spurring short term speculative demand, and there is only so much that the market can deviate from the norm. Which means that any downturn would probably be closer to the 4% downturn between 1990 and 1992:

Behind the scenes I’ve been working on all of these, but I don’t have any of them nailed down enough to post something more explicit.

To give you an example of what is bedeviling the data, let’s take a look at the choice of homeownership vs. renting - which is one of the drivers of new housing.

There are two primary government sources for rental prices: (1) the monthly CPI report, under the category “rent of primary residence;” and (2) the quarterly homeownership and vacancy report, which includes a measure of “median asking rent.”

You would think the two statistics would be reasonably close to one another.

You would be wrong.

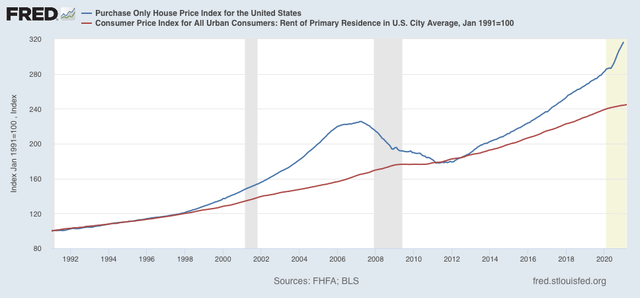

Here is what the CPI measure (red) looks like compared with the FHFA house price index (blue), both normed to 100 as of January 1991:

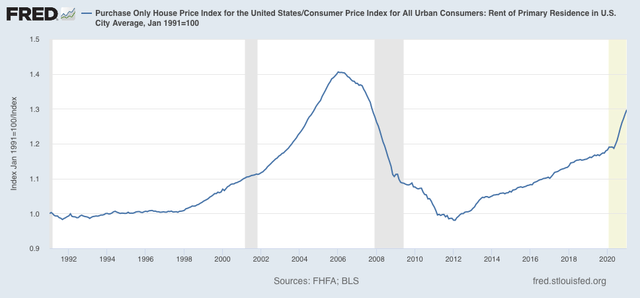

You can see that house prices really took off compared with rents during the housing bubble, and have done so again in the past year. Here’s what that looks like when we divide median house prices by median rents, again norming the statistic to 1 as of January 1991:

The imbalance is about equal to early 2004. Rents have only gone up about 2% in the past year, while house prices have gone up 12%.

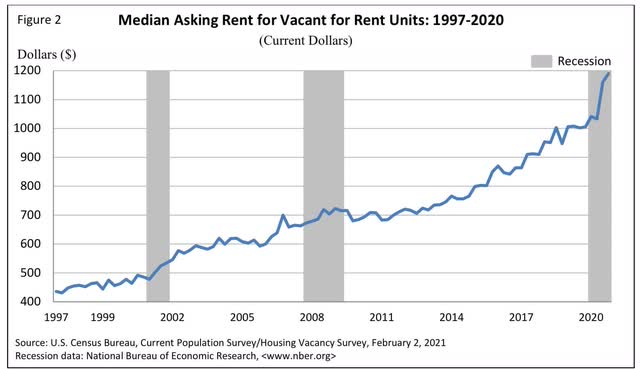

But now let’s take a look at median asking rents:

According to this report, YoY in 2020 rents went up 19%! Quite a difference from the CPI of 2%.

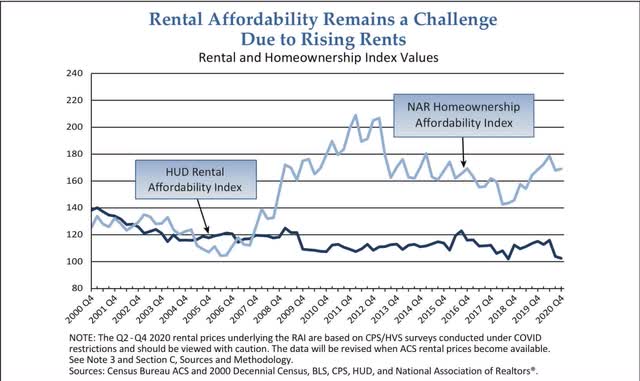

As a result, according to HUD, here’s what housing affordability looks like compared with rental affordability as of their most recent report in February:

According to this metric, relatively speaking housing is much more affordable than renting.

So the CPI report and the Quarterly affordability report are giving us completely contradictory results, with completely opposite implications for housing going forward.