- by New Deal democrat

The last housing market data for 2021, the FHFA and Case Shiller house price indexes, were reported this morning. Both showed a very slight deceleration in the soaring prices that have marked this year.

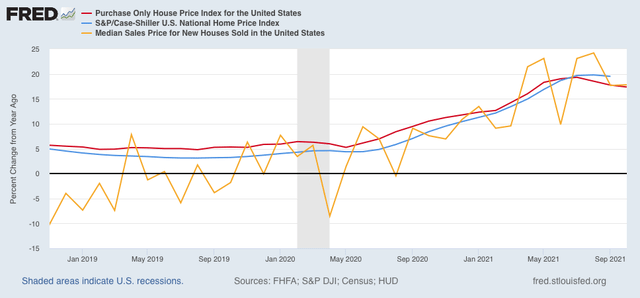

The FHFA purchase only index rose 1.1% for October. The YoY% increase was 17.4%, down from the 19.3% YoY peak in July. Meanwhile the Case Shiller national index rose 0.8% m/m, and is up 19.1% YoY, vs. its peak of 19.8% in August. This is similar to what we have already seen with the median prices of new houses for sale (gold):

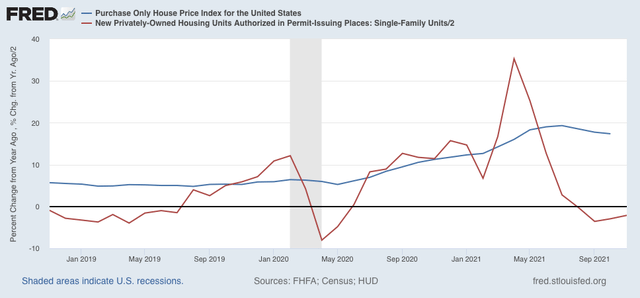

As I always note, prices follow sales. Below are new home sales and single family housing permits (red, /2 for scale) vs. the FHFA index as above:

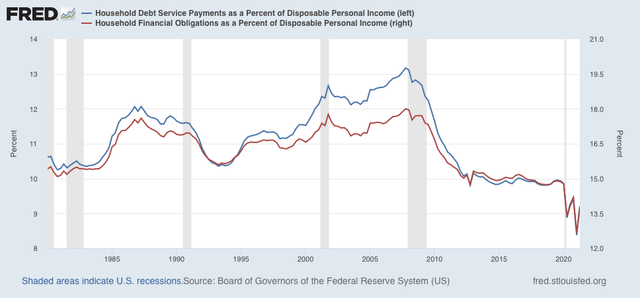

As expensive as houses are, they have not yet reached a crisis point as they did in 2006. This is because, although both average hourly wages and house price have increased roughly 60% since that time, mortgage rates, are just over 3% vs. 6.5% or higher back then. In other words, the amount of disposable income it takes the average household to service their mortgage and other debts in 2021 is only about 2/3’s of what it was at the peak of the housing bubble in 2006:

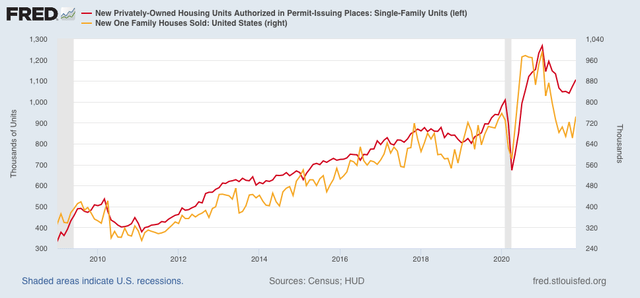

So while both single family housing permits and new home sales have been down as much as 30% this year from their peak at the end of last year, they remain even with their best performance in the entire decade leading up to the pandemic:

This is not a housing market that is in any serious trouble. While the downturn in housing activity this year will create a drag on the economy next year, it is very unlikely to put the economy as a whole into a recession.