- by New Deal democrat

As usual, we started out the month with the forward-looking ISM manufacturing report for October, as well as construction spending for September.

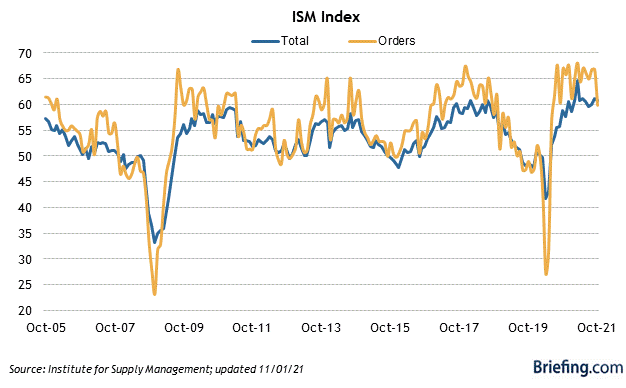

Let’s take the ISM report first, since it is an important short leading indicator for the production sector. Here the total index declined slightly - mere -03 - to 60.8, and the more leading new orders subindex declined sharply - by -6.9 to 59.8:

Since the break even point between increasing and decreasing numbers of respondents, both of October’s numbers in fact show strong expansion - in the case of new orders, simply not nearly so strong as in most of the last 12 months. In short, still quite positive.

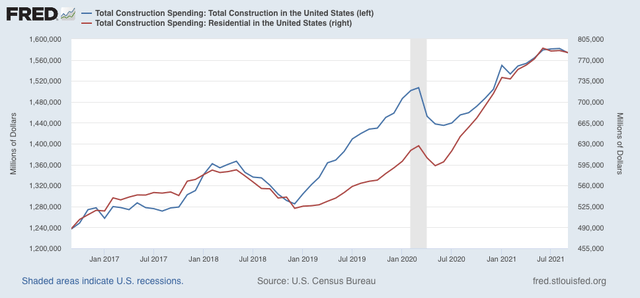

Turning to construction, in nominal terms overall spending including all types of construction declined -0.5%, while spending on the leading residential sector declined -0.4%, but still at levels very close to their all-time highs:

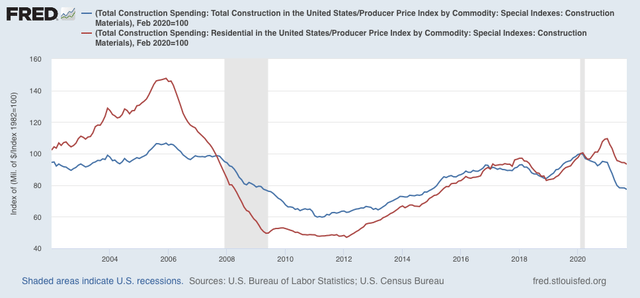

Adjusting for price changes in construction materials, which jumped by 0.7% in September, “real” construction spending declined -1.3%m/m, and “real” residential construction spending declined -1.1%. In absolute terms, “real” construction spending has declined sharply earlier this year, although there has been relative stabilization in the last few months:

“Real” total construction spending has now declined -18.7% since its post-recession peak in November 2020, while “real” residential construction spending has declined -14.8% since its post-recession peak in January of this year.

The above shows that, while total construction spending has declined by more than it had before the Great Recession, the decline in residential construction spending, while substantial, is nowhere near the big decline it suffered before the end of 2007 in this series that only dates from 2002.

This gives us essentially the same message that we got from single family housing permits several weeks ago: there has been a big decline in this long leading sector, but not yet what would typically precede a recession.